Instructions For Arizona Form 140 - Resident Personal Income Tax Return - 2014

ADVERTISEMENT

Arizon

na Form

20

014 Reside

ent Perso

onal Incom

me Tax R

Return

1

140

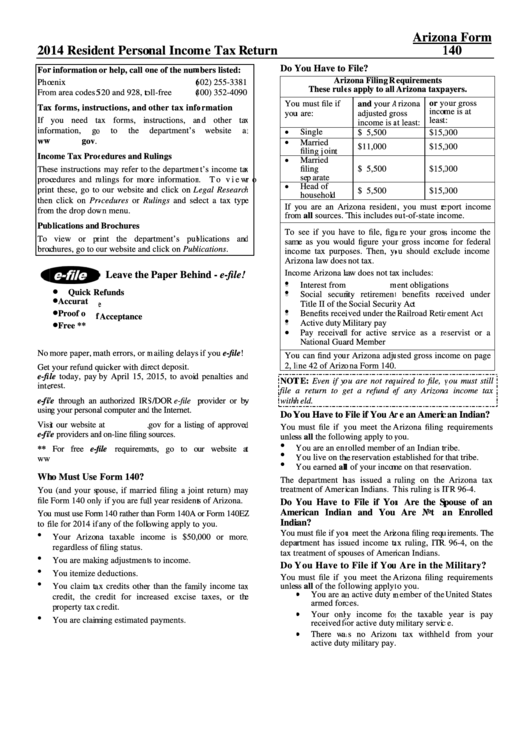

Do Y

You Have to

File?

For

r information

or help, call o

one of the num

mbers listed:

Ariz

izona Filing R

Requirements

Pho

oenix

(6

602) 255-3381

These rule

es apply to all

Arizona taxpa

ayers.

Fro

m area codes 5

520 and 928, to

oll-free

(8

800) 352-4090

or yo

our gross

You

u must file if

and your A

Arizona

Tax

x forms, instr

ructions, and

other tax info

ormation

incom

me is at

you

u are:

adjusted gr

ross

If

you need ta

ax forms, in

nstructions, an

nd other tax

x

least

t:

income is a

at least:

info

ormation,

go

o

to

the

department’s

website

at

t

Single

$ 5,500

$15,0

000

ww

ww.azdor.gov.

Married

$11,000

$15,0

000

filing joint

Inc

ome Tax Proc

cedures and R

Rulings

Married

filing

$ 5,500

$15,0

000

The

ese instructions

s may refer to

the departmen

nt’s income tax

x

separate

proc

cedures and ru

ulings for mor

re information

n. To view or

r

Head of

prin

nt these, go to

our website a

and click on L

Legal Research

h

$ 5,500

$15,0

000

household

then

n click on Pro

ocedures or R

ulings and sel

lect a tax type

e

If y

you are an Ar

rizona resident

t, you must re

eport income

from

m the drop dow

wn menu.

from

m all sources. T

This includes o

out-of-state inc

come.

Pub

blications and

d Brochures

To

see if you hav

ave to file, figu

ure your gross

s income the

To

view or pr

rint the depa

artment’s pub

blications and

d

sam

me as you wou

uld figure your

r gross incom

me for federal

broc

chures, go to o

our website and

d click on Publ

lications.

inco

ome tax purpo

oses. Then, yo

ou should exc

clude income

Ariz

zona law does

not tax.

Inco

ome Arizona la

aw does not tax

x includes:

Leave the

Paper Beh

ind - e-file!

Interest from

U.S. Governm

ment obligation

ns

Quick R

Refunds

Social securi

ity retirement

t benefits rec

ceived under

Title II of the

Social Securit

ty Act

Accurate

e

Benefits recei

ived under the

Railroad Retir

rement Act

Proof of

f Acceptance

Active duty M

Military pay

Free **

Pay received

d for active se

ervice as a re

eservist or a

National Gua

ard Member

No

more paper, m

math errors, or m

mailing delays

if you e-file!

You

u can find you

ur Arizona adju

usted gross inc

ome on page

2, li

ine 42 of Arizo

ona Form 140.

Get

t your refund q

quicker with dir

rect deposit.

e-fi

ile today, pay

by April 15, 2

2015, to avoid

d penalties and

d

NOT

TE: Even if yo

ou are not req

quired to file, y

you must still

inte

erest.

file a

a return to g

get a refund of

of any Arizona

a income tax

e-fil

le through an

authorized IR

S/DOR e-file p

provider or by

y

withh

held.

usin

ng your persona

al computer and

d the Internet.

Do Y

You Have to F

File if You Ar

re an Americ

can Indian?

Visi

it our website

at

.gov for a listin

ng of approved

d

You

must file if y

you meet the A

Arizona filing

requirements

e-fil

le providers and

d on-line filing

sources.

unles

ss all the follow

wing apply to y

you.

Y

You are an enr

rolled member

of an Indian tr

ribe.

**

For free e-f

file requiremen

nts, go to ou

ur website at

t

Y

You live on the

e reservation e

established for

that tribe.

ww

ww.azdor.gov.

Y

You earned all

l of your incom

me on that reser

rvation.

Wh

ho Must Use

Form 140?

The

department h

has issued a r

ruling on the

Arizona tax

treatm

ment of Ameri

ican Indians. T

This ruling is IT

TR 96-4.

You

u (and your sp

pouse, if marri

ied filing a join

nt return) may

y

file

Form 140 only

y if you are ful

ll year resident

ts of Arizona.

Do Y

You Have to

o File if You

u Are the Sp

pouse of an

Ame

erican India

an and You

Are Not a

an Enrolled

You

u must use Form

m 140 rather tha

an Form 140A o

or Form 140EZ

Z

India

an?

to f

file for 2014 if

any of the follo

owing apply to

o you.

You

must file if you

u meet the Ariz

zona filing requ

uirements. The

Your Arizon

na taxable inc

come is $50,

000 or more,

,

depar

rtment has iss

sued income ta

ax ruling, ITR

R 96-4, on the

regardless of

filing status.

tax tr

reatment of spo

ouses of Amer

rican Indians.

You are maki

ing adjustment

ts to income.

Do Y

You Have to

o File if You

u Are in the

Military?

You itemize d

deductions.

You

must file if y

you meet the A

Arizona filing

requirements

unles

ss all of the fol

llowing apply t

to you.

You claim ta

ax credits other

r than the fam

mily income tax

x

You are an

n active duty m

member of the

United States

credit, the c

credit for incr

reased excise

taxes, or the

e

armed forc

ces.

property tax c

credit.

Your only

y income for

r the taxable

year is pay

You are claim

ming estimated

payments.

received fo

for active duty

military servic

ce.

There wa

as no Arizona

a tax withheld

d from your

active duty

y military pay.

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26