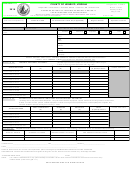

SCHEDULE A FOR FORM 103-SR

MARCH 1, 2010

Part of State Form 53854 (R / 12-09)

NOTE:

The location numbers shown below must correspond with the locations and location numbers shown on the front of this form (Form 103-SR) and on

the reverse side of Form 104-SR.

DEPRECIABLE PERSONAL PROPERTY

LOCATION NUMBER

#

#

#

#

#

#

TAXING DISTRICT NUMBER

COLUMN A

COLUMN B

COLUMN A

COLUMN B

COLUMN A

COLUMN B

LINE

YEAR OF ACQUISITION

TTV%

TOTAL COST

TTV

TOTAL COST

TTV

TOTAL COST

TTV

1

From

to 3-1-10

40%

2

3-2-09 to 3-1-10

40%

3

3-2-08 to 3-1-09

60%

4

3-2-07 to 3-1-08

55%

5

3-2-06 to 3-1-07

45%

6

3-2-05 to 3-1-06

37%

7

3-2-04 to 3-1-05

30%

8

3-2-03 to 3-1-04

25%

9

3-2-02 to 3-1-03

20%

10

3-2-01 to 3-1-02

16%

11

3-2-00 to 3-1-01

12%

12

Prior

to 3-2-00

10%

13

TOTALS

14

30% of line 13, Column A

Line 15 must be the greater of Line 13, Column B or Line 14 [see 50 IAC 4.2-4-9]

15

Total True Tax Value (TTV)of

Depreciable Personal Property

(to Summary on Form 103-SR)

DEPRECIABLE PERSONAL PROPERTY

LOCATION NUMBER

#

#

#

TAXING DISTRICT NUMBER

#

#

#

COLUMN A

COLUMN B

COLUMN A

COLUMN B

COLUMN A

COLUMN B

LINE

YEAR OF ACQUISITION

TTV%

TOTAL COST

TTV

TOTAL COST

TTV

TOTAL COST

TTV

1

From

to 3-1-10

40%

2

3-2-09 to 3-1-10

40%

3

3-2-08 to 3-1-09

60%

4

3-2-07 to 3-1-08

55%

5

3-2-06 to 3-1-07

45%

6

3-2-05 to 3-1-06

37%

7

3-2-04 to 3-1-05

30%

8

3-2-03 to 3-1-04

25%

9

3-2-02 to 3-1-03

20%

10

3-2-01 to 3-1-02

16%

11

3-2-00 to 3-1-01

12%

12

Prior

to 3-2-00

10%

13

TOTALS

14

30% of line 13, Column A

Line 15 must be the greater of Line 13, Column B or Line 14 [see 50 IAC 4.2-4-9]

15

Total True Tax Value (TTV)of

Depreciable Personal Property

(to Summary on Form 103-SR)

Election to report cost of Depreciable Assets by Federal tax year.

Yes

No

Election available only when federal tax year ends December 31 or January 31

If taxpayer elects to report cost above on federal tax year basis, assets acquired from the prior federal tax year end to March 1 are to be reported

on the first line of the appropriate pool.

Page ______ of ______

1

1 2

2