Form 355-Es - Corporate Estimated Tax Payment - Massachusetts Department Of Revenue - 2014

ADVERTISEMENT

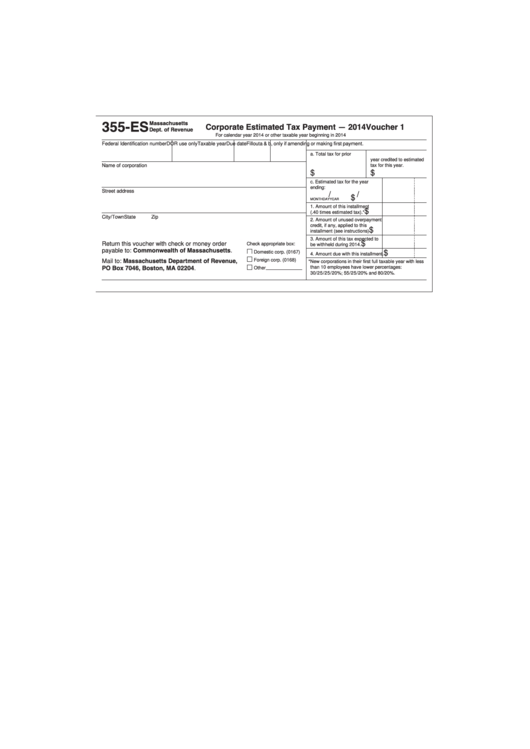

355-ES

Corporate Estimated Tax Payment — 2014

Voucher 1

Massachusetts

Dept. of Revenue

For calendar year 2014 or other taxable year beginning in 2014

Federal Identification number

DOR use only

Taxable year

Due date

Fill out a & b, only if amending or making first payment.

a. Total tax for prior year.

b. Overpayment from last

year credited to estimated

Name of corporation

tax for this year.

$

$

c. Estimated tax for the year

ending:

Street address

/

/

$

MONTH

DAY

YEAR

1. Amount of this installment

$

(.40 times estimated tax).*

City/Town

State

Zip

2. Amount of unused overpayment

credit, if any, applied to this

$

installment (see instructions)

3. Amount of this tax expected to

payable to: Commonwealth of Massachusetts.

$

Return this voucher with check or money order

Check appropriate box:

be withheld during 2014.

Mail to: Massachusetts Department of Revenue,

$

Domestic corp. (0167)

4. Amount due with this installment.

PO Box 7046, Boston, MA 02204.

Foreign corp. (0168)

*New corporations in their first full taxable year with less

than 10 employees have lower percentages:

Other

30/25/25/20%; 55/25/20% and 80/20%.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4