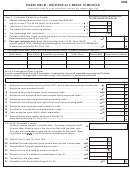

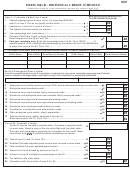

*150104CR39999*

FORM 104CR (09/10/15)

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0005

Name

Account Number

22. School-to-Career Investment credit, submit a copy of the

certification

22

0 0

0 0

23. Colorado Works Program credit, submit a copy of the letter from

the county Dept. of Social/Human Services

23

0 0

0 0

24. Child Care Contribution credit, submit form(s) DR 1317

24

0 0

0 0

25. Long-term Care Insurance credit, submit a year-end statement to

show premiums paid

25

0 0

0 0

26. Aircraft Manufacturer New Employee credit, submit Forms DR

0085 and DR 0086

26

0 0

0 0

27. Credit for remediation of contaminated land, submit a

copy of the CDPHE certification when claiming this credit

27

0 0

0 0

28. Colorado Job Growth Incentive credit, submit certification from

OEDIT

28

0 0

0 0

29. Certified Auction Group License Fee credit, submit a copy of the

certification

29

0 0

0 0

30. Advanced Industry Investment credit, submit a copy of the

certification

30

0 0

0 0

31. Low-income Housing credit, submit CHFA certification

31

0 0

0 0

32. Credit for Food Contributed to Hunger-Relief Charitable

Organizations, submit Form(s) DR 0346

32

0 0

0 0

33. Alternative Fuel Refueling Facility credit, carryforward from

2010 only

33

0 0

0 0

34. Total of column A

34

0 0

35. Nonrefundable Credits Used, total of column B plus any amount from line 16. Also enter this

amount on line 35 of Form 104

35

0 0

36. Carryforward Amount, subtract line 35 from line 34 - excluding any expiring carryforwards

36

0 0

1

1 2

2 3

3