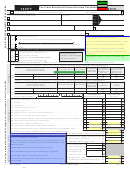

Arizona Form 140py - Part-Year Resident Personal Income Tax Return - 2014 Page 2

ADVERTISEMENT

Your Name (as shown on page 1)

Your Social Security Number

00

40 Enter the amount from page 1, line 39 ........................................................................................................................... 40

00

41 Recalculated Arizona depreciation ................................................................................................................................. 41

00

42 2013 Arizona depreciation adjustment ........................................................................................................................... 42

00

43 Adjustment for I.R.C. §179 expense not allowed ........................................................................................................... 43

00

44 Interest on U.S. obligations such as U.S. savings bonds and treasury bills ................................................................... 44

00

45 Arizona state lottery winnings included as income on your federal return (up to $5,000 only) ...................................... 45

00

46 U.S. Social Security or Railroad Retirement Act benefits included in your Arizona income ........................................... 46

00

47 Other subtractions:

.................................................................... 47

See instructions on page 12 and include your own schedule

00

48 Subtract lines 41 through 47 from line 40 ....................................................................................................................... 48

00

49 Age 65 or over:

................................................................ 49

Multiply the number in box 8 by $2,100

00

50 Blind:

............................................................................... 50

Multiply the number in box 9 by $1,500

00

51 Dependents:

.................................................................. 51

Multiply the number in box 10 by $2,300

00

52 Qualifying parents and grandparents:

........................... 52

Multiply the number in box 11 by $10,000

00

53 Add lines 49 through 52........................................................................................................... 53

00

54 Multiply line 53 by the Arizona percentage on line 28 .................................................................................................... 54

00

55 Arizona adjusted gross income:

........................................................................................ 55

Subtract line 54 from line 48

I

00

56 Deductions: Check box and enter amount.

ITEMIZED

S

STANDARD 56

See instructions on page 15 .........

56

56

00

57 Personal exemptions:

............................................................................................................. 57

See instructions of page 16

00

58 Arizona taxable income:

............................................................................................ 58

Subtract lines 56 and 57 from line 55

00

59 Compute the tax using amount from line 58 and Tax Table X or Y ................................................................................. 59

00

60 Tax from recapture of credits from Arizona Form 301, Part 2, line 38 ............................................................................ 60

00

61 Subtotal of tax:

....................................................................................................... 61

Add lines 59 and 60 and enter the total

00

62 Family income tax credit

....................................................................... 62

(from your worksheet on page 17 in the instructions)

00

63 Credits from Arizona Form 301, Part 2, line 72 .............................................................................................................. 63

00

64 Balance of tax:

.................. 64

Subtract lines 62 and 63 from line 61. If the sum of lines 62 and 63 is more than line 61, enter zero

00

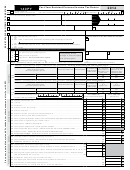

65 Arizona income tax withheld during 2014 ....................................................................................................................... 65

00

66 Arizona estimated tax payments for 2014 ...................................................................................................................... 66

00

67 2014 Arizona extension payment (Form 204)................................................................................................................. 67

00

68 Increased Excise Tax Credit from worksheet:

........................................................................ 68

See instructions on page 19

00

69 Other refundable credits:

.......................

1

308-I

2

342

3

349 69

Check the box(es) and enter the total amount

69

69

69

00

70 Total payments and refundable credits:

....................................................... 70

Add lines 65 through 69 and enter the total

00

71 TAX DUE:

....... 71

If line 64 is larger than line 70, subtract line 70 from line 64, and enter amount of tax due. Skip lines 72, 73 and 74

00

72 OVERPAYMENT:

....................... 72

If line 70 is larger than line 64, subtract line 64 from line 70, and enter amount of overpayment

00

73 Amount of line 72 to be applied to 2015 estimated tax................................................................................................... 73

00

74 Balance of overpayment:

....................................................................................................... 74

Subtract line 73 from line 72

Solutions Teams Assigned to

00

00

75 - 85 Voluntary Gifts to:

76

75

Arizona Wildlife ...............

Schools ....................................

00

00

00

77

78

79

Child Abuse Prevention .......

Domestic Violence Shelter ......

Political Gift.....................

00

00

00

80

81

82

National Guard Relief Fund .

Neighbors Helping Neighbors..

Special Olympics ............

Sustainable State Parks

00

00

00

83

84

Veterans’ Donations Fund ...

I Didn’t Pay Enough Fund........

85

and Road Fund ...............

86 Political Party

1

2

3

4

5

(if amount is entered on line 79 - check only one):

86

Americans Elect 86

Democratic 86

Libertarian 86

Republican 86

AZ Green Party

00

87 Estimated payment penalty and Arizona Long-Term Health Care Savings Account (AZLTHSA) penalty ...................... 87

88

1

2

3

4

Annualized/Other

Farmer or Fisherman

Form 221 included

AZLTHSA Penalty

88

88

88

88

89 Add lines 75 through 85 and 87; enter the total............................................................................................................. 89

00

00

90 REFUND:

.......................................................... 90

Subtract line 89 from line 74. If less than zero, enter amount owed on line 91

A

A

Direct Deposit of Refund: Check box

if your deposit will be ultimately placed in a foreign account; see instructions.

90

90

ROUTING NUMBER

ACCOUNT NUMBER

C

Checking or

98

S

Savings

91 AMOUNT OWED:

Add lines 71 and 89.

Make check payable to Arizona Department of Revenue; write your SSN on payment,

00

................................................................................................................................................. 91

and include with your return

I have read this return and any documents with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are true, correct and complete.

Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

YOUR SIGNATURE

DATE

OCCUPATION

SPOUSE’S SIGNATURE

DATE

SPOUSE’S OCCUPATION

PAID PREPARER’S SIGNATURE

DATE

FIRM’S NAME (PREPARER’S IF SELF-EMPLOYED)

PAID PREPARER’S STREET ADDRESS

PAID PREPARER’S TIN

(

)

PAID PREPARER’S CITY

STATE

ZIP CODE

PAID PREPARER’S PHONE NUMBER

If you are sending a payment with this return, mail to Arizona Department of Revenue, PO Box 52016, Phoenix, AZ, 85072-2016.

If you are expecting a refund or owe no tax, or owe tax but are not sending a payment, mail to Arizona Department of Revenue, PO Box 52138, Phoenix, AZ, 85072-2138.

AZ Form 140PY (2014)

Page 2 of 3

ADOR 10149 (14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3