Form 3 Instruction - Local Individual Consumer'S Use Tax Return

ADVERTISEMENT

INSTRUCTIONS

WHO MUST FILE. Every individual incurring a consumer’s use

the Local Individual Consumer’s Use Tax Schedule, Column B, by

tax liability must file a Nebraska and Local Individual Consumer’s

reducing the tax to reflect the net local tax after the credit. The

Use Tax Return, Form 3.

invoices or tax return showing payment in another state of sales or use

tax on the item(s) must be retained with the taxpayer’s records.

Individual consumer’s use tax applies to all property including alcoholic

SPECIFIC INSTRUCTIONS

liquor purchased from out-of-state retailers, suppliers, or manufacturers

LINE 1. Enter the cost of all items including alcoholic liquor

and delivered to the purchaser in Nebraska. If the property is delivered

outside Nebraska but is subsequently brought into Nebraska for

purchased without payment of Nebraska sales or use tax and

purposes of storage, use, or consumption, individual consumer’s use

consumed or used in Nebraska.

tax still applies if the purchaser has not paid sales tax in the other state

LINE 2. Enter the cost of all inventory items purchased for resale

in an amount equal to or greater than the total amount due in Nebraska.

without payment of Nebraska sales or use tax which were withdrawn

Individual consumer’s use tax also applies to purchases made in

from inventory and consumed or used in Nebraska.

Nebraska if the sales tax has not been paid or the property was

LINE 5. If you paid sales tax in another state on any of the

purchased tax exempt and subsequently consumed in a taxable manner.

purchases included on line 3, you may take a credit for the tax you

ALCOHOLIC LIQUOR. Every individual who purchases alcoholic

paid. The credit on line 5 cannot exceed the Nebraska use tax for

liquor such as alcohol and spirits, beer, or wine, on and after

such purchases. Additional credit against the local use tax may also

August 1, 2000, is required to remit the alcoholic liquor gallonage

be allowed. Please refer to “Credit for Tax Paid in Other States,” in

tax, provided an alcohol excise tax has not been paid either in another

these instructions. The invoices or tax return showing the payment

state or in this state. The alcoholic liquor gallonage tax must be

in another state of sales or use tax must be retained with your

reported on line 9. To determine the amount of alcoholic liquor

records.

gallonage tax owed, please refer to the Specific Instructions for

LOCAL CONSUMER’S USE TAX SCHEDULE. Enter in

Line 9.

Column A the total cost of items included on line 3 that were

Individuals who are only reporting the individual consumer’s use

delivered within the boundaries of each local jurisdiction you specify.

tax on purchases of alcoholic liquor and the alcoholic liquor

Multiply each amount by the corresponding local jurisdiction’s

gallonage tax are required to report such taxes on or before

consumer’s use tax rate and enter the result in Column B, Local

Consumer’s Use Tax. See enclosed rate card.

January 25 of the year after the alcoholic liquor was purchased.

LINE 9. The Alcoholic Liquor Gallonage Tax Rate Schedule printed

WHEN AND WHERE TO FILE. This return, properly signed and

below sets forth the tax rate per gallon and per ounce for beer, wine

accompanied by check or money order payable to the Nebraska

containing less than 14% alcohol, wine containing 14% or more of

Department of Revenue, will be considered timely filed if postmarked

alcohol, and distilled alcohol and spirits.

on or before the twenty-fifth day of the month following the tax period

covered by the return. Mail to the Nebraska Department of Revenue,

To determine the amount of alcoholic liquor gallonage tax owed, multiply

P.O. Box 98923, Lincoln, Nebraska 68509-8923.

the total number of ounces of each type of alcoholic liquor purchased by

the per ounce tax rate and report that amount on line 9. You can also

PENALTY AND INTEREST. Penalty and interest may be assessed

determine the tax per bottle (ounces per bottle times tax rate per ounce)

for failure to timely file a return or timely pay the total amount of

and then multiply that amount by the number of bottles purchased.

tax when due, submitting bad checks, filing false or fraudulent

returns, or failing to keep adequate records.

Example: John purchased two cases of wine from a company in

another state via the Internet on August 2, 2000. Each bottle

VERIFICATION AND AUDIT. Records to substantiate this return

contained 750 milliliters of wine (less than 14% alcohol) and the

shall be retained and be available for a period of three years following

tax was not paid to the other state. John owes the Nebraska alcoholic

the date of filing the return.

liquor gallonage tax on the 24 bottles of wine. To determine the

CREDIT FOR TAX PAID IN OTHER STATES. This credit

amount of tax owed, using the conversion table below, multiply 24

includes both city and state amounts. If a taxpayer has properly paid a

bottles by 25.4 ounces equals 609.6 total ounces times $.0059 per

tax in another state with respect to the purchase or use of an item for

ounce equals tax of $3.60. Alternatively, the tax per bottle is

which the consumer’s use tax liability would apply, a credit for the

determined by multiplying 25.4 fl. oz. by $.0059 or $.15 per bottle

dollar amount of tax paid in the other state may be applied against the

times 24 bottles equals tax of $3.60.

total of the taxpayer’s Nebraska and local consumer’s use tax liability

LINE 10. Attach a check or money order payable to the Nebraska

for that item. If the credit is equal to or greater than the tax due in

Department of Revenue for the amount reported on line 10.

Nebraska, then no use tax is due in Nebraska. If the credit is less than

SIGNATURES. This return must be signed by the taxpayer. If the

the tax due in Nebraska, then the difference is due in Nebraska. It may

taxpayer authorizes another person to sign this return, there must be a

be necessary to allocate the credit between state and local taxes. The

power of attorney on file with the Nebraska Department of Revenue.

credit should be applied first against the amount of any tax due the

state on the item(s) in question. Any remaining portion of the credit

Any person who is paid for preparing a taxpayer’s return must also

should then be applied against the local tax imposed on the item(s) on

sign the return as preparer.

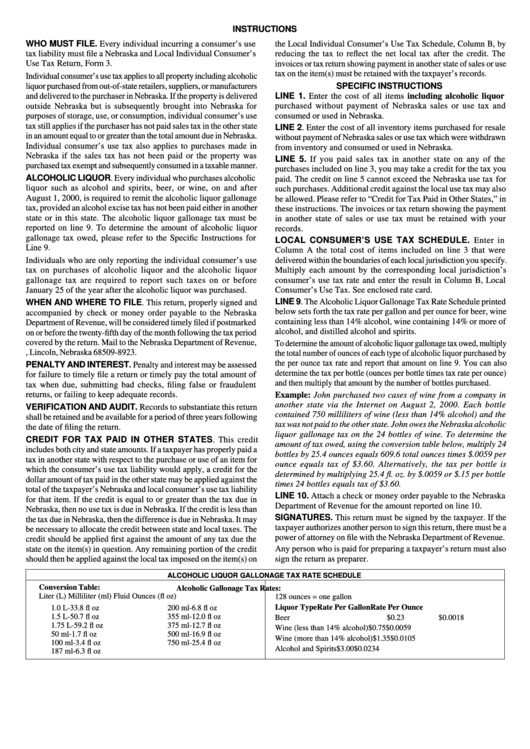

ALCOHOLIC LIQUOR GALLONAGE TAX RATE SCHEDULE

Conversion Table:

Alcoholic Gallonage Tax Rates:

Liter (L) Milliliter (ml) Fluid Ounces (fl oz)

128 ounces = one gallon

Liquor Type

Rate Per Gallon

Rate Per Ounce

1.0 L

- 33.8 fl oz

200 ml -

6.8 fl oz

1.5 L

- 50.7 fl oz

355 ml - 12.0 fl oz

Beer

$0.23

$0.0018

1.75 L

- 59.2 fl oz

375 ml - 12.7 fl oz

Wine (less than 14% alcohol)

$0.75

$0.0059

50 ml

-

1.7 fl oz

500 ml - 16.9 fl oz

Wine (more than 14% alcohol)

$1.35

$0.0105

100 ml -

3.4 fl oz

750 ml - 25.4 fl oz

Alcohol and Spirits

$3.00

$0.0234

187 ml -

6.3 fl oz

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1