Print Form

Clear Form

l

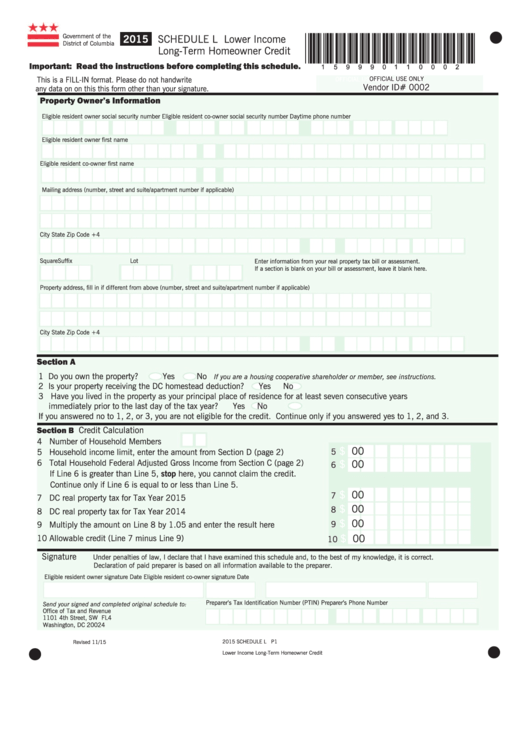

Government of the

2015

SCHEDULE L Lower Income

*159990110002*

District of Columbia

Long-Term Homeowner Credit

Important: Read the instructions before completing this schedule.

This is a FILL-IN format. Please do not handwrite

OFFICIAL USE ONLY

OFFICIAL USE ONLY

Vendor ID# 0002

any data on on this this form other than your signature.

Property Owner’s Information

Eligible resident owner social security number

Eligible resident co-owner social security number

Daytime phone number

Eligible resident owner first name

M.I.

Last name

Eligible resident co-owner first name

M.I.

Last name

Mailing address (number, street and suite/apartment number if applicable)

City

State

Zip Code +4

Square

Suffix

Lot

Enter information from your real property tax bill or assessment.

If a section is blank on your bill or assessment, leave it blank here.

Property address, fill in if different from above (number, street and suite/apartment number if applicable)

City

State

Zip Code +4

Section A

1 Do you own the property?

Yes

No

If you are a housing cooperative shareholder or member, see instructions.

2 Is your property receiving the DC homestead deduction?

Yes

No

3 Have you lived in the property as your principal place of residence for at least seven consecutive years

immediately prior to the last day of the tax year?

Yes

No

If you answered no to 1, 2, or 3, you are not eligible for the credit. Continue only if you answered yes to 1, 2, and 3.

Section B Credit Calculation

4 Number of Household Members

$

.00

5 Household income limit, enter the amount from Section D (page 2)

5

6 Total Household Federal Adjusted Gross Income from Section C (page 2)

$

.00

6

If Line 6 is greater than Line 5, stop here, you cannot claim the credit.

Continue only if Line 6 is equal to or less than Line 5.

$

.00

7

7 DC real property tax for Tax Year 2015

$

.00

8

8 DC real property tax for Tax Year 2014

$

.00

9

9 Multiply the amount on Line 8 by 1.05 and enter the result here

$

.00

10 Allowable credit (Line 7 minus Line 9)

10

Signature

Under penalties of law, I declare that I have examined this schedule and, to the best of my knowledge, it is correct.

Declaration of paid preparer is based on all information available to the preparer.

Eligible resident owner signature

Date

Eligible resident co-owner signature

Date

Preparer’s Tax Identification Number (PTIN)

Preparer’s Phone Number

Send your signed and completed original schedule to:

Office of Tax and Revenue

1101 4th Street, SW FL4

Washington, DC 20024

2015 SCHEDULE L P1

Revised 11/15

l

l

Lower Income Long-Term Homeowner Credit

1

1 2

2