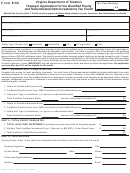

Instructions for the Qualified Business Designation Application - Form QBA

Qualified Equity and Subordinated Debt Investments Tax Credit

Pursuant to Va. Code § 58.1-339.4, this credit is effective for taxable years beginning on and after January 1, 1999. 23

VAC 10-110-225 et seq. provide regulations on this credit, including definitions of terms used in this application. Virginia

Tax Bulletin 00-5, dated July 31, 2000, also provides additional information on this credit. For a copy of the applicable

regulations, Tax Bulletin, or additional forms, see the Where to Get Help section.

Under Va. Code § 58.1-339.4 (E), the Qualified Equity and

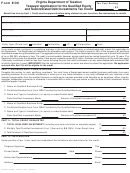

Who Must File This Application, Form QBA

Subordinated Debt Investments Tax Credit is capped at $5

Businesses that want to sell equity and subordinated debt

million annually. Of the amount of available credit, one-half of

investments for which taxpayers may claim credit for the

this amount must be allocated to commercialization investments

Qualified Equity and Subordinated Debt Investments Tax

and the other half is available for all other qualifying investments.

Credit must file. The qualification is valid for the calendar

If credit applications for either half exceed the allowed amount,

year of the application. A separate application is required for

the credits for that half will be prorated. If credit applications for

each year that the business wants to be eligible to offer this

either half are less than the allowed amount, the balance will

credit to its investors.

be available for allocation to the other type of credits.

All businesses should be registered with the Department

Where to Get Help

before completing Form QBA. If you are not registered,

complete Form R-1.

Write to Department of Taxation, Tax Credit Unit, P. O. Box

715, Richmond, VA 23218-0715 or call 804-786-2992. To

When to File This Application, Form QBA

order forms, bulletins or regulations call 804-440-2541. Visit

File Form QBA any time during the calendar year.

for most Virginia tax forms, regulations

and additional tax information. Forms are available from your

You need to reapply each year that you plan to be designated

local Commissioner of the Revenue, Director of Finance or

as a qualified business.

Director of Tax Administration.

Where to File This Application, Form QBA

Tenemos servicios disponible en Español.

File Form QBA with the Department of Taxation, Tax Credit

General Information Concerning This Credit

Unit, P.O. Box 715, Richmond, VA 23218-0715.

The Qualified Equity and Subordinated Debt Investments Tax

You may also fax it to 804-774-3902, but please do not do

Credit is allowed to taxpayers making a qualified investment

both.

in the form of equity or subordinated debt from a qualifying

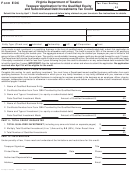

Information to Be Provided to Taxpayers (Investors)

business which is engaged in business or does substantially

all of its production in Virginia. The credit equals 50% of the

Upon issuance of equity or subordinated debt, the qualified

amount of qualifying investments made during the taxable

business must provide each taxpayer with a copy of the

year. The total amount of credit that may be used per taxable

qualified business certification from the Department and a

year is the lesser of the tax imposed or $50,000. The credit

statement on the business entity’s letterhead that contains

is nonrefundable. Excess credits may be carried forward for

the following information:

up to 15 years. If total annual requests for this credit exceed

• The investor’s name;

$4.5 million, the Department will prorate the allowable credit

• The investment by amount (list each amount separately);

for each taxpayer.

• The investment by type (equity or debt);

Taxpayers cannot receive a grant from the Small Business

• The investment by date (specific to each investment

Investment Grant Fund and take the Qualified Equity and

amount); and

Subordinated Debt Investments Tax Credit for the same

• Verification that the investment meets the definition of

investment.

a “qualified investment” for the purposes of claiming

the credit pursuant to Va. Code § 58.1-339.4. 23 VAC

• Equity received in connection with a qualified business

10-110-225 et seq. provide regulations on how this credit

investment must be held by the taxpayer for at least 3 full

applies.

calendar years following the calendar year for which a tax

credit is allocated.

Please specifically state that the investor (name), nor any

of his/her family members, nor any entity affiliated with

• Subordinated Debt received in connection with a qualified

him/her receives or has received compensation from the

business investment must be held by the taxpayer for at

qualified business in exchange for services provided to

least 3 years from the date of issuance.

such business as an employee, officer, director, manager,

• Holding Period Exception – Liquidation of the qualified

independent contractor or otherwise in connection

business issuing such equity; the merger, consolidation or

with or within 1 year before or after the date of such

other acquisition of such business; with or by a party not

investment. For the purposes hereof, reimbursement of

affiliated with such business or the death of the taxpayer.

reasonable expenses incurred shall not be deemed to be

If the 3 calendar year holding period is not met, the taxpayer

compensation.

forfeits the unused credit amount and will be assessed for

• The statement should be signed by a company officer.

the credit used, to which shall be added interest, computed

For investors affiliated with the qualified business, such

at the rate of 1% per month, compounded monthly from the

as a Corporate Officer, CFO, etc., the statement should be

date the tax credits were claimed.

signed by another member of the company.

1

1 2

2 3

3 4

4