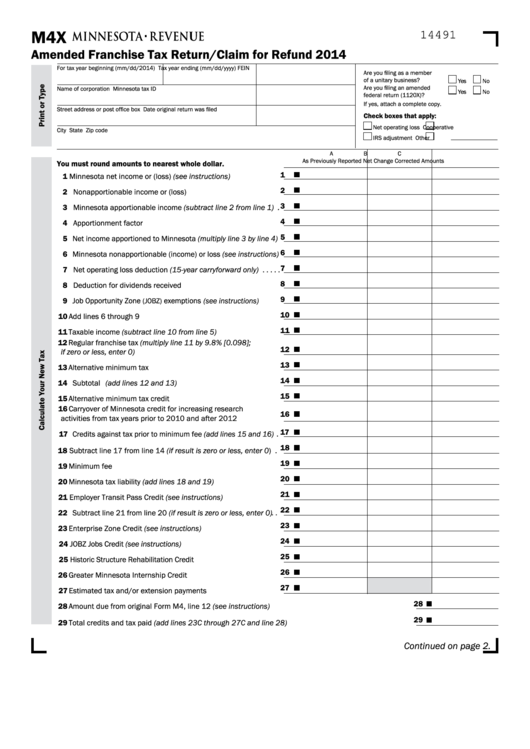

M4X

14491

Amended Franchise Tax Return/Claim for Refund 2014

For tax year beginning (mm/dd/2014)

Tax year ending (mm/dd/yyyy)

FEIN

Are you filing as a member

of a unitary business? . . . . . . .

Yes

No

Are you filing an amended

Name of corporation

Minnesota tax ID

Yes

No

federal return (1120X)? . . . . . .

If yes, attach a complete copy .

Street address or post office box

Date original return was filed

Check boxes that apply:

Net operating loss

Cooperative

City

State

Zip code

IRS adjustment

Other

A

B

C

As Previously Reported

Net Change

Corrected Amounts

You must round amounts to nearest whole dollar.

1

1 Minnesota net income or (loss) (see instructions) . . . . . . . . . . .

2

2 Nonapportionable income or (loss) . . . . . . . . . . . . . . . . . . . . . . .

3

3 Minnesota apportionable income (subtract line 2 from line 1)

4

4 Apportionment factor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Net income apportioned to Minnesota (multiply line 3 by line 4)

6

6 Minnesota nonapportionable (income) or loss (see instructions)

7

7 Net operating loss deduction (15-year carryforward only) . . . . .

8

8 Deduction for dividends received . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Job Opportunity Zone

exemptions (see instructions) . . . . .

(JOBZ)

10

10 Add lines 6 through 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11 Taxable income (subtract line 10 from line 5) . . . . . . . . . . . . . . .

12 Regular franchise tax (multiply line 11 by 9 8% [0 098];

12

if zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13 Alternative minimum tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

14 Subtotal (add lines 12 and 13) . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

15 Alternative minimum tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Carryover of Minnesota credit for increasing research

16

activities from tax years prior to 2010 and after 2012 . . . . . . . .

17

17 Credits against tax prior to minimum fee (add lines 15 and 16) .

18

18 Subtract line 17 from line 14 (if result is zero or less, enter 0) .

19

19 Minimum fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

20 Minnesota tax liability (add lines 18 and 19) . . . . . . . . . . . . . . .

21

21 Employer Transit Pass Credit (see instructions) . . . . . . . . . . . . . .

22

22 Subtract line 21 from line 20 (if result is zero or less, enter 0) . .

23

23 Enterprise Zone Credit (see instructions) . . . . . . . . . . . . . . . . . . .

24

24 JOBZ Jobs Credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . .

25

25 Historic Structure Rehabilitation Credit . . . . . . . . . . . . . . . . . . . . .

26

26 Greater Minnesota Internship Credit . . . . . . . . . . . . . . . . . . . . . .

27

27 Estimated tax and/or extension payments . . . . . . . . . . . . . . . . .

28

28 Amount due from original Form M4, line 12 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

29 Total credits and tax paid (add lines 23C through 27C and line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Continued on page 2

1

1 2

2 3

3 4

4 5

5