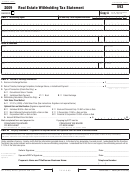

2015 Instructions for Form 593

Real Estate Withholding Tax Statement

General Information

Use Form 593-V, Payment Voucher for Real

Mail forms and payment for the amount of tax

Estate Withholding, to remit real estate

withheld within 20 days following the end of

Do Not Round Cents to Dollars – On this form,

withholding payments to the FTB. Form

the month in which the transaction occurred.

do not round cents to the nearest whole dollar.

593-V should be used whether Form(s) 593,

Mail to:

Enter the amounts with dollars and cents as

is submitted electronically or by mail. The

FRANCHISE TAX BOARD

actually withheld.

withholding agent must use Form 593-V when

PO BOX 942867

Installment Sales – The withholding agent is

remitting a payment by check or money order.

SACRAMENTO CA 94267-0651

required to report as an installment sale (check

Payments may also be automatically withdrawn

Distribute the other two copies of Form 593

box B, Installment Sale Payment, on Line 3) if

from a bank account via an electronic funds

as follows:

the transaction is structured as an installment

transfer (EFT).

sale as evidenced by a promissory note. The

• Send one copy to the seller or transferor

withholding agent is required to withhold

B Helpful Hints

within 20 days following the end of the

3

/

% (.0333) of the first installment payment.

month in which the transaction occurred.

1

3

Year of Form – The year (at the top) of

• One copy will be retained by the withholding

Buyers are required to withhold on the

Form 593 must be the same as the year on

agent for a minimum of five years and must

principal portion of each subsequent

line 2. See instructions for line 2. If you do

be provided to the FTB upon request.

installment payment if the sale of California real

not have Form 593 with the correct year, go to

property is structured as an installment sale.

ftb.ca.gov to get the correct form.

E Amending Form 593

Withhold on Installment Sale Elect-out

Identification Numbers – Check to see that the

Method – If the seller or transferor elects not

An amended Form 593 can only be filed by

withholding agent’s and seller’s or transferor's

to report the sale on the installment method

the withholding agent. If a seller or transferor

identification numbers are correct and listed

notices an error, contact the withholding agent.

(Internal Revenue Code Section 453[d]),

in the same order as the names. If both a

the seller or transferor must file a California

To amend a Form 593 previously filed on the

husband/RDP and wife/RDP are listed, make

tax return and report the entire sale on

correct year form, but reporting incorrect

sure both social security numbers (SSNs)

Schedule D-1, Sale of Business Property. After

information:

or individual taxpayer identification numbers

filing the tax return and reporting the entire

(ITINs) are listed in the same order as their

• Complete a new Form 593 with the correct

gain, the seller or transferor must submit a

names.

information. Use the same year form as

written request to the Franchise Tax Board

originally filed, and check the “Amended”

Trusts and Trustees – It is important to report

(FTB) to release the buyer from withholding

box on the top left corner of the form.

the correct name and identification number

on the installment sale payments. Once the

• Attach a letter to Form 593 explaining what

when title is held in the name of a trust. If the

request is received, FTB will issue an approval

changes were made and why.

seller or transferor is a trust, see the Specific

or denial within 30 days.

Instructions on page 2, Part II, Seller or

To amend a Form 593 previously filed using an

Registered Domestic Partners (RDP) – For

Transferor.

incorrect year form:

purposes of California income tax, references

Preparer’s Name and Title/Escrow Business

• Complete a new Form 593 with the

to a spouse, husband, or wife also refer to a

Name – Provide the preparer’s name and

withholding information using the correct

California RDP, unless otherwise specified.

title/escrow’s business name and phone

year form. Do not check the “Amended” box

When we use the initials RDP they refer to both

number.

on the top left corner of the form.

a California registered domestic “partner” and

• Complete a new Form 593 using the same

a California registered domestic “partnership,”

C Who Must File

year form that was originally filed. Check

as applicable. For more information on

the “Amended” box on the top left corner

RDPs, get FTB Pub. 737, Tax Information for

Any real estate escrow person (REEP) who

of the form, and enter $0.00 as the amount

Registered Domestic Partners.

withheld on the sale or transfer of California

withheld on line 5 of the form.

real property must file Form 593 to report the

A Purpose

• Attach a letter to each Form 593 explaining

amount withheld. If this is an installment sale

what changes were made and why.

payment after escrow closed, then the buyer is

Use Form 593, Real Estate Withholding Tax

the responsible person.

Mail the Form(s) 593 and letter(s) to the

Statement, to report real estate withholding on

address indicated under General Information D,

sales closing in 2015, on installment payments

D When and Where to File

When and Where to File.

made in 2015, or on exchanges that were

Whenever an amended Form 593 is filed with

completed or failed in 2015.

You need three completed copies of Form 593

the FTB, each affected seller or transferor

for filing and distribution. File a copy of

Use a separate Form 593 to report the amount

should also be provided with a copy.

Form 593 and Form 593-V, along with the

withheld from each seller or transferor. If the

amount of tax withheld and mail to the address

Do not file an amended Form 593 to cancel

sellers or transferors are married or RDPs and

shown in this section.

they plan to file a joint return, include both

the withholding amount for a Form 593-C,

Real Estate Withholding Certificate, filed after

spouses/RDPs on the same Form 593.

For installment sales, with the principal

the close of escrow. After escrow has closed,

portion of the first installment payment, file

If the sellers or transferors are married or

amounts withheld may be recovered only by

a copy of Form 593, Form 593-

, Real Estate

RDPs and they are entered as one seller or

I

claiming the withholding as a credit on the

Withholding Installment Sale Acknowledgement,

transferor, we treat them as having equal

appropriate year’s tax return. Get Form 593-C

Form 593-V, a copy of the promissory note,

ownership interest. If the ownership interest

for more information.

and the amount of tax withheld. For subsequent

is not equal, separate Forms 593 need to

installment payments, the buyer should file

be filed for each individual to represent the

a copy of only Form 593 and Form 593-V

correct ownership interest percentage. If

along with the amount of tax withheld. You do

the information submitted is incorrect, an

not need to obtain the seller's or transferor's

amended Form 593 must be submitted to the

signature on each subsequent and completed

FTB by the withholding agent.

Form 593.

Form 593 Instructions 2014 Page 1

1

1 2

2 3

3 4

4 5

5