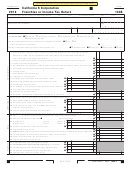

Schedule M-1

Reconciliation of Income (Loss) per Books With Income (Loss) per Return.

If the S corporation completed federal Schedule M-3 (Form 1120S) . See instructions .

5 Income recorded on books this year not

1 Net income per books . . . . . . . . . . . . . . . . . . . . .

included on Schedule K, line 1 through

2 Income included on Schedule K, line 1 through

line 10b (itemize)

line 10b, not recorded on books this year

a Tax-exempt interest $___________________

(itemize)______________________________

b Other $______________________________

_____________________________________

c Total . Add line 5a and line 5b . . . . . . . . . . .

3 Expenses recorded on books this year not

6 Deductions included on Schedule K, line 1

included on Schedule K, line 1 through

through line 12e, not charged against

line 12e (itemize)

book income this year (itemize)

a Depreciation . . . . . $____________________

a Depreciation $ ________________________

b State taxes . . . . . . $____________________

b State tax refunds $ _____________________

c Travel and

c Other $______________________________

entertainment . . . . $____________________

d Total . Add line 6a through line 6c . . . . . . . .

d Other . . . . . . . . . . . $____________________

7 Total . Add line 5c and line 6d . . . . . . . . . . . . . . . .

e Total . Add line 3a through line 3d . . . . . . . .

8 Income (loss) (Schedule K, line 19, col . d) .

4 Total . Add line 1 through line 3e . . . . . . . . . . . . .

Line 4 less line 7 . . . . . . . . . . . . . . . . . . . . . . .

Schedule M-2

CA Accumulated Adjustments Account, Other Adjustments Account, and Other Retained Earnings. See instructions .

(a)

(b)

(c)

Important: Use California figures and federal procedures.

Accumulated

Other adjustments

Other retained earnings

adjustments

account

(see instructions)

account

1

Balance at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Ordinary income from Form 100S, Side 1, line 1 . . . . . . . . . . . . . . . . . . . . . . .

3

Other additions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

4

Loss from Form 100S, Side 1, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

(

)

(

)

5

Other reductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Combine line 1 through line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Distributions other than dividend distributions . . . . . . . . . . . . . . . . . . . . . . . .

8

Balance at end of year . Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . .

9

Retained earnings at end of year . Add line 8, column (a) through column (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If the corp . has C corp . E&P at the end of the taxable year, check the box and enter the amount . See instructions . . . . . . . . .

Schedule V

Cost of Goods Sold

00

1 Inventory at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

2 Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 Cost of labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Other IRC Section 263A costs . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Other costs . Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

00

6 Total . Add line 1 through line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Cost of goods sold . Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

Was there any change in determining quantities, costs, or valuations between opening and closing inventory? . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If “Yes,’’ attach an explanation . Enter California seller’s permit number, if any _______________________________________

Method of inventory valuation

Check if the LIFO inventory method was adopted this taxable year for any goods . If checked, attach federal Form 970 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If the LIFO inventory method was used for this taxable year, enter the amount of closing inventory computed under LIFO . . . . .

________________________

Form 100S

2014 Side 5

3615143

C1

1

1 2

2 3

3 4

4 5

5 6

6