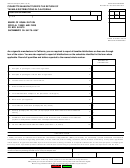

BOE-501-MIT (BACK) REV. 2 (3-11)

INSTRUCTIONS - TOBACCO PRODUCTS SCHEDULE

GENERAL

The California State Board of Equalization (BOE) is responsible for administering the Cigarette and Tobacco Products Tax Law, including

the distribution of untaxed tobacco products. Pursuant to Business and Professions Code, section 22979.24, every manufacturer or

importer is required to file a monthly report to the BOE in a manner specified by the BOE. Failure to comply with the requirements may

result in suspension or revocation of a license pursuant to the provisions set forth in section 30148 of the Revenue and Taxation Code.

DEFINITIONS

Tobacco Products include, but are not limited to, all forms of cigars, smoking tobacco, chewing tobacco, snuff and any other articles or

products made of, or containing at least fifty percent (0.50) tobacco; but does not include cigarettes.

Wholesale Cost means the cost of tobacco products and samples, including the dollar value of samples, and the dollar value of any

manufacturer's discounts or trade allowances (Revenue and Taxation Code section 30017 and 30123).

For example, the wholesale cost of any manufactured tobacco product that is distributed in a taxable manner shall include all

manufacturing costs, the cost of raw material, including waste materials not incorporated into the final product, the cost of labor, any

direct and indirect overhead costs, the wholesale markup and any Federal Excise and/or U.S. Custom's Taxes paid.

In addition to the price paid for the tobacco product, the wholesale cost of any tobacco product that is imported into this state directly

from outside the country shall include any Federal Excise or U.S. Custom's Taxes paid.

Importer means any purchaser for resale in the United States of cigarettes or tobacco products manufactured outside of the United

States for the purpose of making a first sale or distribution within the United States.

Manufacturer means a manufacturer of cigarettes or tobacco products sold in this state.

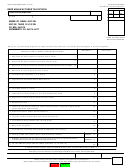

PREPARATION OF SCHEDULE

Complete this schedule in full. Attach the schedule to your monthly tax return (BOE-501-TIM) and mail to the State Board of

Equalization, Special Taxes and Fees, P.O. Box 942879, Sacramento, CA 94279-0088. Retain a copy for your files.

If more space is needed, you may copy this form or download a copy from our website at

This report/schedule should include nontaxable sales of taxable tobacco products pursuant to Revenue and Taxation Code sections

30103 or 30105 (sales to Licensed Distributors), sales in Interstate or Foreign Commerce, sales to Common Carriers engaged in

Interstate or Foreign Passenger Service, sales to U.S. Military Exchanges and Commissaries, and/or sales to U.S. Veterans

Administration (Revenue and Taxation Code sections 30102, 30103.5, and 30105.5). Distributions of taxable tobacco products

pursuant to Revenue and Taxation Code section 30008 shall be reported on BOE-501-CT,

Tobacco Products Distributor Tax Return.

LINE BY LINE INSTRUCTIONS

Column A.

Enter date of the delivery or shipment of tobacco products into California.

Column B.

Enter the name of the purchaser.

Column C.

Enter the California license number (LD Q ET 90-XXXXXX) or enter the following codes for other sales:

100 - Interstate and Foreign Commerce

200 - Common Carriers engaged in Interstate and Foreign Passenger Service

300 - United States Army, Air Force, Navy, Marine Corps or Coast Guard exchanges and commissaries

and Navy or Coast Guard ships' stores and/or the United Sates Veterans' Administration

400 - Sales or transfer to law enforcement (requires prior authorization from the BOE)

Column D.

Enter the invoice or document number associated with the delivery or shipment.

Column E.

Enter the number below that corresponds with the type of tobacco products delivered or shipped.

1. Snuff

4. Cigars

2. Chewing Tobacco

5. Roll-Your-Own

3. Pipe Tobacco

6. Other type of tobacco product

Column F.

Enter the tobacco product brand name.

Column G.

Enter the ounces only if the product was roll-your-own tobacco delivered or shipped.

Column H.

Enter the wholesale cost (including cents) of tobacco products delivered or shipped into California. Add the total wholesale

cost for the reporting period and enter this amount on line 1A of BOE-501-TIM, Tobacco Products Manufacturer/Importer

Return.

If you need additional information, please contact the State Board of Equalization, Special Taxes and Fees, P.O. Box 942879,

Sacramento, CA 94279-0088. You may also visit the BOE website at or call the Taxpayer Information Section at

800-400-7115 (TTY: 711); from the main menu, select the option Special Taxes and Fees.

1

1 2

2