4190010101

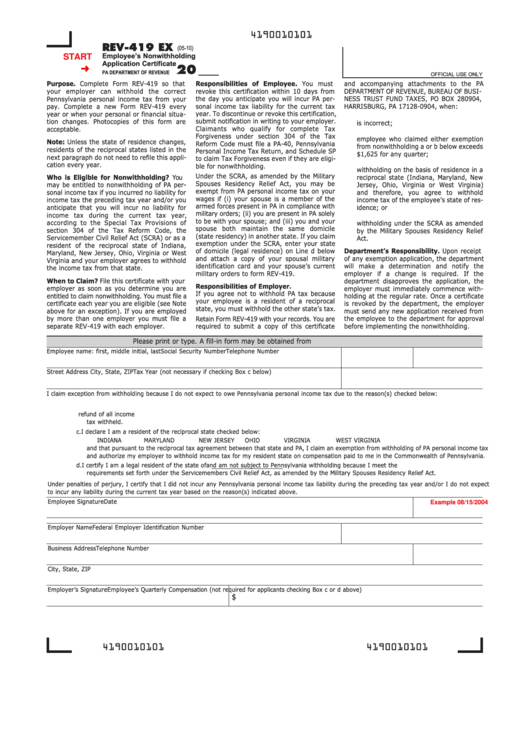

REV-419 EX

(05-10)

START

Employee’s Nonwithholding

Application Certificate

20

PA DEPARTMENT OF REVENUE

OFFICIAL USE ONLY

Purpose. Complete Form REV-419 so that

Responsibilities of Employee. You must

and accompanying attachments to the PA

your employer can withhold the correct

revoke this certification within 10 days from

DEPARTMENT OF REVENUE, BUREAU OF BUSI-

Pennsylvania personal income tax from your

the day you anticipate you will incur PA per-

NESS TRUST FUND TAXES, PO BOX 280904,

pay. Complete a new Form REV-419 every

sonal income tax liability for the current tax

HARRISBURG, PA 17128-0904, when:

year. To discontinue or revoke this certification,

year or when your personal or financial situa-

1.

you have reason to believe this certificate

submit notification in writing to your employer.

tion changes. Photocopies of this form are

is incorrect;

Claimants who qualify for complete Tax

acceptable.

2.

the PA taxable gross compensation of any

Forgiveness under section 304 of the Tax

employee who claimed either exemption

Note: Unless the state of residence changes,

Reform Code must file a PA-40, Pennsylvania

from nonwithholding a or b below exceeds

residents of the reciprocal states listed in the

Personal Income Tax Return, and Schedule SP

$1,625 for any quarter;

next paragraph do not need to refile this appli-

to claim Tax Forgiveness even if they are eligi-

3.

the employee claims an exemption from

cation every year.

ble for nonwithholding.

withholding on the basis of residence in a

Under the SCRA, as amended by the Military

Who is Eligible for Nonwithholding? You

reciprocal state (Indiana, Maryland, New

Spouses Residency Relief Act, you may be

may be entitled to nonwithholding of PA per-

Jersey, Ohio, Virginia or West Virginia)

exempt from PA personal income tax on your

and therefore, you agree to withhold

sonal income tax if you incurred no liability for

wages if (i) your spouse is a member of the

income tax of the employee’s state of res-

income tax the preceding tax year and/or you

armed forces present in PA in compliance with

idence; or

anticipate that you will incur no liability for

military orders; (ii) you are present in PA solely

income tax during the current tax year,

4.

the employee claims an exemption from

to be with your spouse; and (iii) you and your

according to the Special Tax Provisions of

withholding under the SCRA as amended

spouse both maintain the same domicile

section 304 of the Tax Reform Code, the

by the Military Spouses Residency Relief

(state residency) in another state. If you claim

Servicemember Civil Relief Act (SCRA) or as a

Act.

exemption under the SCRA, enter your state

resident of the reciprocal state of Indiana,

of domicile (legal residence) on Line d below

Department’s Responsibility. Upon receipt

Maryland, New Jersey, Ohio, Virginia or West

and attach a copy of your spousal military

of any exemption application, the department

Virginia and your employer agrees to withhold

identification card and your spouse’s current

will make a determination and notify the

the income tax from that state.

military orders to form REV-419.

employer if a change is required. If the

When to Claim? File this certificate with your

department disapproves the application, the

Responsibilities of Employer.

employer as soon as you determine you are

employer must immediately commence with-

If you agree not to withhold PA tax because

entitled to claim nonwithholding. You must file a

holding at the regular rate. Once a certificate

your employee is a resident of a reciprocal

certificate each year you are eligible (see Note

is revoked by the department, the employer

state, you must withhold the other state’s tax.

above for an exception). If you are employed

must send any new application received from

by more than one employer you must file a

Retain Form REV-419 with your records. You are

the employee to the department for approval

separate REV-419 with each employer.

required to submit a copy of this certificate

before implementing the nonwithholding.

Please print or type. A fill-in form may be obtained from

Employee name: first, middle initial, last

Social Security Number

Telephone Number

Street Address City, State, ZIP

Tax Year (not necessary if checking Box c below)

I claim exception from withholding because I do not expect to owe Pennsylvania personal income tax due to the reason(s) checked below:

a. Last year I qualified for Tax Forgiveness of my PA personal income tax liability and had a right to a full refund of all income tax withheld.

b. This year I expect to qualify for Tax Forgiveness of my PA personal income tax liability and expect to have a right to a full refund of all income

tax withheld.

c. I declare I am a resident of the reciprocal state checked below:

INDIANA

MARYLAND

NEW JERSEY

OHIO

VIRGINIA

WEST VIRGINIA

and that pursuant to the reciprocal tax agreement between that state and PA, I claim an exemption from withholding of PA personal income tax

and authorize my employer to withhold income tax for my resident state on compensation paid to me in the Commonwealth of Pennsylvania.

d. I certify I am a legal resident of the state of

and am not subject to Pennsylvania withholding because I meet the

requirements set forth under the Servicemembers Civil Relief Act, as amended by the Military Spouses Residency Relief Act.

Under penalties of perjury, I certify that I did not incur any Pennsylvania personal income tax liability during the preceding tax year and/or I do not expect

to incur any liability during the current tax year based on the reason(s) indicated above.

Employee Signature

Date

Example 08/15/2004

PLEASE SIGN AFTER PRINTING.

Employer Name

Federal Employer Identification Number

Business Address

Telephone Number

City, State, ZIP

Employer’s Signature

Employee’s Quarterly Compensation (not required for applicants checking Box c or d above)

$

PLEASE SIGN AFTER PRINTING.

Reset Entire Form

PRINT FORM

4190010101

4190010101

1

1