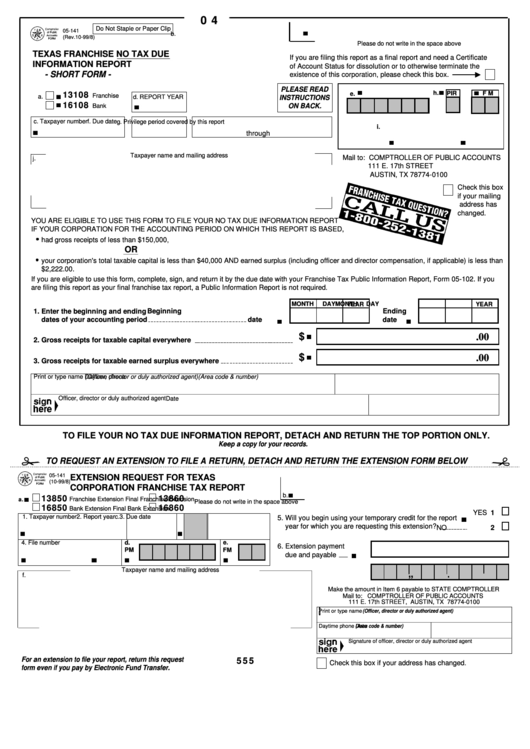

04

Do Not Staple or Paper Clip

05-141

b.

(Rev.10-99/8)

Please do not write in the space above

TEXAS FRANCHISE NO TAX DUE

If you are filing this report as a final report and need a Certificate

INFORMATION REPORT

of Account Status for dissolution or to otherwise terminate the

- SHORT FORM -

existence of this corporation, please check this box.

PLEASE READ

13108

h.

PIR

F M

e.

Franchise

a.

d. REPORT YEAR

INSTRUCTIONS

16108

ON BACK.

Bank

c. Taxpayer number

f. Due date

g. Privilege period covered by this report

i.

through

Taxpayer name and mailing address

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

j.

111 E. 17th STREET

AUSTIN, TX 78774-0100

Check this box

if your mailing

address has

changed.

YOU ARE ELIGIBLE TO USE THIS FORM TO FILE YOUR NO TAX DUE INFORMATION REPORT

IF YOUR CORPORATION FOR THE ACCOUNTING PERIOD ON WHICH THIS REPORT IS BASED,

had gross receipts of less than $150,000,

OR

your corporation's total taxable capital is less than $40,000 AND earned surplus (including officer and director compensation, if applicable) is less than

$2,222.00.

If you are eligible to use this form, complete, sign, and return it by the due date with your Franchise Tax Public Information Report, Form 05-102. If you

are filing this report as your final franchise tax report, a Public Information Report is not required.

MONTH

DAY

MONTH

DAY

YEAR

YEAR

1. Enter the beginning and ending

Beginning

Ending

dates of your accounting period

date

date

$

.00

2. Gross receipts for taxable capital everywhere

$

.00

3. Gross receipts for taxable earned surplus everywhere

Print or type name

(Officer, director or duly authorized agent)

Daytime phone

(Area code & number)

Officer, director or duly authorized agent

Date

TO FILE YOUR NO TAX DUE INFORMATION REPORT, DETACH AND RETURN THE TOP PORTION ONLY.

Keep a copy for your records.

TO REQUEST AN EXTENSION TO FILE A RETURN, DETACH AND RETURN THE EXTENSION FORM BELOW

05-141

EXTENSION REQUEST FOR TEXAS

(10-99/8)

CORPORATION FRANCHISE TAX REPORT

b.

13850

13860

a.

Franchise Extension

Final Franchise Extension

Please do not write in the space above

16850

16860

Bank Extension

Final Bank Extension

YES

1

1. Taxpayer number

2. Report year

c.

3. Due date

5. Will you begin using your temporary credit for the report

year for which you are requesting this extension?

NO

2

4. File number

d.

e.

6. Extension payment

PM

FM

due and payable

Taxpayer name and mailing address

,

,

.

f.

Make the amount in Item 6 payable to STATE COMPTROLLER

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

111 E. 17th STREET, AUSTIN, TX 78774-0100

a

Print or type name

(Officer, director or duly authorized agent)

(Area code & number)

Daytime phone

Date

Signature of officer, director or duly authorized agent

For an extension to file your report, return this request

555

Check this box if your address has changed.

form even if you pay by Electronic Fund Transfer.

1

1