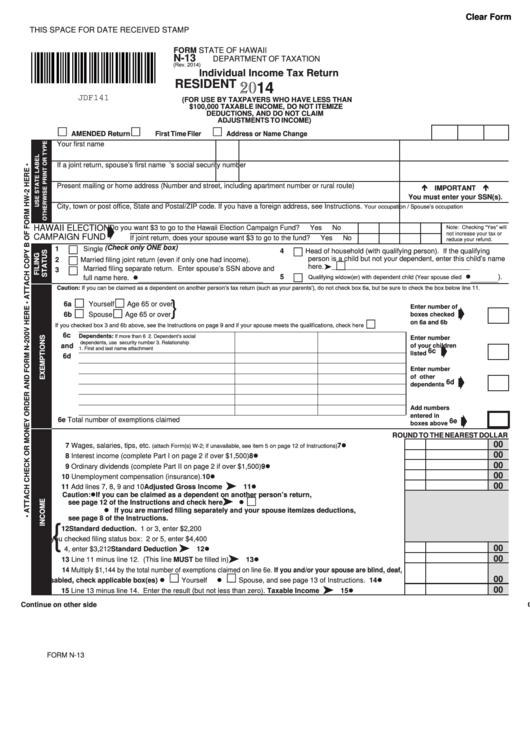

Clear Form

THIS SPACE FOR DATE RECEIVED STAMP

FORM

STATE OF HAWAII

N-13

DEPARTMENT OF TAXATION

(Rev. 2014)

Individual Income Tax Return

2014

RESIDENT

JDF141

(FOR USE BY TAXPAYERS WHO HAVE LESS THAN

$100,000 TAXABLE INCOME, DO NOT ITEMIZE

DEDUCTIONS, AND DO NOT CLAIM

ADJUSTMENTS TO INCOME)

AMENDED Return

First Time Filer

Address or Name Change

Your first name

M.I.

Last name

Your social security number

If a joint return, spouse’s first name

M.I.

Last name

Spouse’s social security number

Present mailing or home address (Number and street, including apartment number or rural route)

IMPORTANT

You must enter your SSN(s).

Your occupation / Spouse’s occupation

City, town or post office, State and Postal/ZIP code. If you have a foreign address, see Instructions.

HAWAII ELECTION

Do you want $3 to go to the Hawaii Election Campaign Fund? .................

Yes

No

Note: Checking “Yes” will

not increase your tax or

CAMPAIGN FUND

If joint return, does your spouse want $3 to go to the fund? ......................

Yes

No

reduce your refund.

(Check only ONE box)

1

Single

4

Head of household (with qualifying person). If the qualifying

person is a child but not your dependent, enter this child’s name

2

Married filing joint return (even if only one had income).

here. ä

Married filing separate return. Enter spouse’s SSN above and

3

Qualifying widow(er) with dependent child (Year spouse died _______ ).

full name here. ________________________________

5

Caution: If you can be claimed as a dependent on another person’s tax return (such as your parents’), do not check box 6a, but be sure to check the box below line 11.

}

6a

Yourself ...........................

Age 65 or over ..............................................................................

Enter number of

ç

6b

Spouse ...........................

Age 65 or over ..............................................................................

boxes checked

on 6a and 6b

If you checked box 3 and 6b above, see the Instructions on page 9 and if your spouse meets the qualifications, check here

Dependents:

6c

If more than 6

2. Dependent’s social

Enter number

dependents, use

security number

3. Relationship

and

of your children

ç

1. First and last name

attachment

6c

listed

6d

Enter number

of other

ç

6d

dependents

Add numbers

entered in

ç

6e Total number of exemptions claimed .....................................................................................................

6e

boxes above

ROUND TO THE NEAREST DOLLAR

7 Wages, salaries, tips, etc. (attach Form(s) W-2; if unavailable, see item 5 on page 12 of Instructions) .................................

00

7

00

8 Interest income (complete Part I on page 2 if over $1,500) ..............................................................................

8

00

9 Ordinary dividends (complete Part II on page 2 if over $1,500) ........................................................................

9

00

10 Unemployment compensation (insurance). .......................................................................................................

10

ä

00

11 Add lines 7, 8, 9 and 10 ......................................................................................Adjusted Gross Income

11

If you can be claimed as a dependent on another person’s return,

Caution:

ä

see page 12 of the Instructions and check here ..............................................

If you are married filing separately and your spouse itemizes deductions,

see page 8 of the Instructions.

{

12 Standard deduction.

1 or 3, enter $2,200

If you checked filing status box:

2 or 5, enter $4,400

ä

00

4, enter $3,212 ...............................................Standard Deduction

12

ä

00

13 Line 11 minus line 12. (This line MUST be filled in) ....................................................................................

13

14 Multiply $1,144 by the total number of exemptions claimed on line 6e. If you and/or your spouse are blind, deaf,

00

or disabled, check applicable box(es)

Yourself

Spouse, and see page 13 of Instructions.

14

ä

00

15 Line 13 minus line 14. Enter the result (but not less than zero). .................................... Taxable Income

15

Continue on other side

Continue on other side

FORM N-13

1

1 2

2