reduction, use Form 589, Nonresident

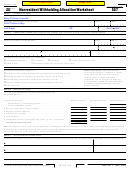

Part I – Withholding Agent

Certification of Nonresident Payee

Reduced Withholding Request . The FTB

Enter the withholding agent’s business or

The payee and/or the authorized

does not grant reductions or waivers for

individual information, not both .

representative must complete, sign,

backup withholding .

date, and return this form to the

Part II – Nonresident Payee

withholding agent .

E Requirement to File a

Enter the payee’s business or individual

Authorized representatives include

information, not both . Check the

California Tax Return

those persons the payee authorized to

appropriate TIN box and provide the ID

act on their behalf through a power of

A payee’s exemption certification

number .

attorney, a third party designee, or other

on Form 587 does not eliminate the

individual taxpayers authorized to view

Part III – Payment Type

requirement to file a California tax return

their confidential tax data via a waiver

and pay the tax due .

The nonresident payee must check the

or release .

box that identifies the type of payment

You may be assessed a penalty if:

being received .

Additional Information

• You do not file a California tax return .

Part IV – Income Allocation

• You file your tax return late .

For additional information or to speak to

• The amount of withholding does not

a representative regarding this form, call

Use Part IV to identify payments that are

satisfy your tax liability .

the Withholding Services and Compliance

subject to withholding . Only payments

telephone service at:

For information on California filing

sourced within California are subject

requirements, go to ftb .ca .gov .

to withholding . Services performed in

Telephone: 888 .792 .4900

California are sourced in California . In the

916 .845 .4900

case of payments for services performed

F How to Claim Non-Wage

Fax:

916 .845 .9512

when part of the services are performed

Withholding Credit

outside California, enter the amount paid

OR write to:

Claim your non-wage withholding credit

for performing services within California

WITHHOLDING SERVICES AND

on one of the following:

in column (a) . Enter the amount paid

COMPLIANCE MS F182

for performing services while outside

• Form 540, California Resident Income

FRANCHISE TAX BOARD

California in column (b) . Enter the total

Tax Return

PO BOX 942867

amount paid for services in column (c) .

• Form 540NR Long, California

SACRAMENTO CA 94267-0651

Nonresident or Part-Year Resident

If the payee’s trade, business, or

You can download, view, and print

Income Tax Return

profession carried on in California is

California tax forms and publications at

• Form 541, California Fiduciary Income

an integral part of a unitary business

ftb .ca .gov .

Tax Return

carried on within and outside California,

OR to get forms by mail write to:

• Form 100, California Corporation

the amounts included on line 1 through

TAX FORMS REQUEST UNIT

Franchise or Income Tax Return

line 5 should be computed by applying

FRANCHISE TAX BOARD

• Form 100S, California S Corporation

the payee’s California apportionment

PO BOX 307

Franchise or Income Tax Return

percentage (determined in accordance

RANCHO CORDOVA CA 95741-0307

• Form 100W, California Corporation

with the provisions of the Uniform

Franchise or Income Tax Return —

Division of Income for Tax Purposes

For all other questions unrelated to

Water’s-Edge Filers

Act) to the payment amounts . For more

withholding or to access the TTY/TDD

• Form 109, California Exempt

information on apportionment, get

numbers, see the information below .

Organization Business Income Tax

Schedule R, Apportionment and Allocation

Internet and Telephone Assistance

Return

of Income .

Website:

ftb .ca .gov

• Form 565, Partnership Return of

Withholding Agent

Telephone: 800 .852 .5711 from within the

Income

United States

Withholding, excluding backup withholding,

• Form 568, Limited Liability Company

916 .845 .6500 from outside

is optional at the discretion of the

Return of Income

the United States

withholding agent on the first $1,500 in

Specific Instructions

TTY/TDD: 800 .822 .6268 for persons

payments made during the calendar year .

with hearing or speech

Withholding must begin as soon as the

Definitions – For withholding terms and

impairments

total payments of California source income

definitions, go to ftb .ca .gov and search

for the calendar year exceed $1,500 . If

Asistencia Por Internet y Teléfono

for withholding terms .

backup withholding is required, there is no

Sitio web: ftb .ca .gov

Private Mail Box (PMB) – Include the

set minimum threshold and it supersedes

Teléfono:

800 .852 .5711 dentro de los

PMB in the address field . Write “PMB”

all types of withholding .

Estados Unidos

first, then the box number . Example: 111

If circumstances change during the year

916 .845 .6500 fuera de los

Main Street PMB 123 .

(such as the total amount of payments),

Estados Unidos

Foreign Address – Enter the information

which would change the amount on line 6,

TTY/TDD: 800 .822 .6268 para personas

in the following order: City, Country,

the payee must submit a new Form 587

con discapacidades auditivas

Province/Region, and Postal Code .

to the withholding agent reflecting those

o del habla

Follow the country’s practice for entering

changes . The withholding agent should

the postal code . Do not abbreviate the

evaluate the need for a new Form 587

country’s name .

when a change in facts occurs .

Page 2 Form 587 Instructions 2014

1

1 2

2 3

3