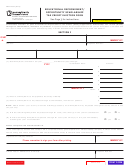

Form Rev-984 - Pennsylvania Organ & Bone Marrow Donor Tax Credit Page 2

ADVERTISEMENT

PENNSYLVANIA ORGAN & BONE MARROW DONOR TAX CREDIT APPLICATION INSTRUCTIONS

PER ACT 65 of 2006

GENERAL INSTRUCTIONS:

Compensation for the period of absence does not include

bonuses paid for prior (or future) performance of services

To claim the PA Organ & Bone Marrow Donor Tax Credit, a taxpayer must

during the period of absence, sales commissions paid for

provide one or more paid leaves of absence to employees for the specific

prior performance of services during the period of absence,

purpose of donating organ or bone marrow. The qualifying leave of

non-cash compensation paid during the period of absence

absence period per employee cannot exceed five days.

(such as personal use of company vehicles), stock options

For purposes of the PA Organ & Bone Marrow Donor Tax Credit, a

exercised during the period of absence, distributions or

“business firm” is defined as an entity subject to PA personal income tax,

payments of previously deferred compensation paid during

corporate net income tax, capital stock/foreign franchise tax, bank and

the period of absence, payments for employee health plans,

trust company shares tax, title insurance companies shares tax,

reimbursements

of

expenses

and

other

items

of

insurance premiums tax, or mutual thrift institutions tax. Business firms

compensation not included in the normal compensation of

also include any natural person as such or as a member of a partnership

an employee.

or a shareholder in a PA S corporation, as well as estates and trusts and

beneficiaries of estates and trusts.

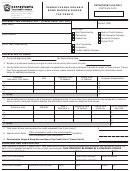

Line 4. Enter total employee compensation paid for the leaves of

absence.

A taxpayer must apply for the PA Organ & Bone Marrow Donor Tax Credit

by the 15th day of the fourth month following the close of the business

Line 5. Enter the temporary help, Federal Employee Identification

firm’s taxable year. The department will notify all taxpayers of the

Number (FEIN) or SSN, Reference Number, Beginning Date of

approved amount of PA Organ & Bone Marrow Donor Tax Credit. The

Service, Ending Date of Service and Temporary Help Paid per

taxpayer may apply the approved credit against PA personal income tax,

employee referenced above.

corporate net income tax, capital stock/foreign franchise tax, bank/trust

Temporary Help – Agency or, if not using an agency,

company shares tax, title insurance companies shares tax, insurance

individual hired to cover the leave of absence of the

premiums tax, or mutual thrift institutions tax for the taxable year in

employee donating an organ or bone marrow.

which the leave of absence was granted. Any unused credits may be

carried over to no more than the three succeeding taxable years. Credits

Reference Number – Line number associated with the

may not be carried back and are not refundable. The credit cannot be

employee for which this temporary help is engaged to cover.

applied against any tax withheld by an employer from an employee

(e.g. If Temporary Help is a replacement for Employee 3a

under Article III of the Tax Reform Code.

listed above, enter 3a.)

A pass-through entity is a partnership or PA S corporation as defined in

Temporary Help Paid – Invoice amount paid to a temporary

Section 301 of the Tax Reform Code. The PA Organ & Bone Marrow Donor

help agency or gross compensation paid to an individual.

Tax Credit applicable to a pass-through entity may be claimed by each

Line 6. Enter total temporary help paid for the leaves of absences of the

partner, member or shareholder on a pro-rata basis in proportion to the

employees donating an organ or bone marrow.

partner, member or shareholder’s portion of the pass-through entity’s

income.

Line 7. Organ & Bone Marrow Donor Tax Credit before Apportionment

(Line 4 plus Line 6)

A business firm that is taxed in more than one state is required to

apportion the credit to determine the proportion of the credit that may

Line 8. Apportionment Factor – Apportionment is determined by

be claimed in Pennsylvania. The apportionment of the credit is

multiplying the available credit by a payroll factor. The numerator

determined by multiplying the available credit by a payroll factor. The

of the factor is the total amount paid in the commonwealth

numerator of the factor is the total amount paid in the commonwealth

during the tax period for compensation and the denominator of

during the tax period for compensation and the denominator of which is

which is the total compensation paid everywhere during the tax

the total compensation paid everywhere during the tax period.

period. The apportionment factor is equal to 1.0 for business

firms whose total compensation paid is entirely in the

LINE INSTRUCTIONS:

Commonwealth of Pennsylvania.

Enter the business firm’s name, address, Revenue ID/SSN and

Line 9. PA Organ & Bone Marrow Donor Tax Credit (Line 7 multiplied by

Federal Employer Identification Number.

Line 8, Apportionment Factor)

Check the block associated with the structure that best identifies

the business firm (check more than one if applicable).

REQUIRED ATTACHMENTS:

Line 1. Enter the beginning and ending dates of the business firm’s tax

For each employee identified on Line 3, include:

period.

1. Employee pay statement for absence period and periods

Line 2. Enter the number of employees donating an organ or bone

immediately preceding and following the absence period.

marrow during the tax period.

2. Letter from a physician describing the procedure and dates of

Line 3. Enter the employee name, Social Security number, Beginning

absence; must reference the employee’s full name.

Date of Leave of Absence, Ending Date of Leave of Absence and

For each temporary help occurrence identified on Line 5, include:

Gross Compensation per employee donating an organ or bone

1. Invoice statement from temporary help agency; must show cost

marrow during the tax period.

per day, not to exceed five days.

Leave of Absence – The period, not exceeding five working

days or the hourly equivalent of five working days per

2. Pay statement to temporary help employee; must list beginning

employee, during which a business firm provides a paid

and ending date of service, not to exceed five days.

leave of absence to the employee for the purpose of organ

The department may contact the taxpayer for additional

or bone marrow donation. The leave of absence does not

documentation necessary to verify the tax credit.

include a period during which an employee utilizes any

Send completed applications (including signature) to:

annual leave or sick days that the employee has been given

by the employer.

Bureau of Corporation Taxes

CD&S Division - OBMD Unit

Employee Compensation - Gross compensation for purposes

of calculating the credit includes salaries and other regular

PO Box 280700

hourly wage payments paid for the period of absence.

Harrisburg, PA 17128-0700

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2