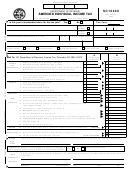

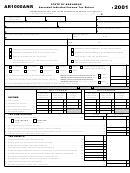

Form Sc1040x - Amended Individual Income Tax Page 4

ADVERTISEMENT

The following instructions refer to line numbers in Column C. If no changes are to be made to lines 1 - 14, use the amounts from the

original return.

Line 1:

Enter the corrected federal taxable income.

Line 2:

Enter the net amount of the changes to the additions (SC1040, Line 2) or subtractions (SC1040, Line 4)

from federal taxable income.

Line 3:

Modified South Carolina taxable income. Line 1 plus or minus line 2. Nonresidents should enter amount

from Part IV, line 34 of this form.

Line 4:

Use the tax tables for the tax year being amended to determine the corrected tax amount. Enter the

amount on line 4.

Line 5:

Make any necessary changes to the tax on lump sum distributions (Attach corrected SC4972), the tax on

active trade or business (Attach corrected I-335), and the tax on excess withdrawals from a Catastrophe

Savings Account.

Line 6:

Add lines 4 and 5. Enter the amount on line 6. This is the total South Carolina tax liability.

Lines 7 - 9:

Enter the corrected credit amounts.

Line 10:

Add lines 7 through 9. Enter the amount on line 10.

Line 11:

Subtract line 10 from line 6 and enter the amount on line 11.

Line 12:

Enter the corrected South Carolina withholding amounts. Attach supporting W-2(s) and/or 1099(s)

documenting the changes made to the total withholding amount.

Line 13:

Enter the corrected South Carolina estimated tax payment amount.

Line 14:

Enter the corrected tuition tax credit or other refundable credit(s) amount. Attach the appropriate corrected

credit form.

Line 15:

Enter the total tax paid with a South Carolina extension and/or original return and any additional payments

on line 15.

Line 16:

Add Column C line 12 through line 15. Enter the total on line 16.

Line 17:

Enter the net refund amount from the original return. Do not include estimated tax transfers or contribution

check-off amounts from the original return.

Line 18:

Subtract line 17 from line 16 and enter the amount on line 18.

Line 19:

Enter the amount of use tax paid on internet, mail-order, or out of state purchases that were reported on

your original return. Any changes to the use tax amount must be made on form UT-3.

Line 20:

Enter the amount of transfers from the original return for estimated tax and/or contribution check-offs.

Line 21:

Add lines 19 and 20. Enter the amount on line 21.

Line 22:

Subtract line 21 from line 18 and enter the amount on line 22. This is the net tax.

If line 22 is larger than Column C line 11, subtract line 11 from line 22 and enter the difference on line 23.

Line 23:

This is the amount to be refunded to you. Overpayments cannot be transferred to another tax year.

Required: Mark your refund choice below on line 23a.

You now have three ways to receive your refund. You can choose direct deposit to have the funds

Line 23a:

deposited directly into your bank account (the fastest option for most filers), or you can choose to have a

debit card or a paper check mailed to you. Debit cards are issued by Bank of America and are subject to

program limitations. Mark an X in one box to indicate your choice. If you choose direct deposit, you must

enter your account information on line 23b.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6