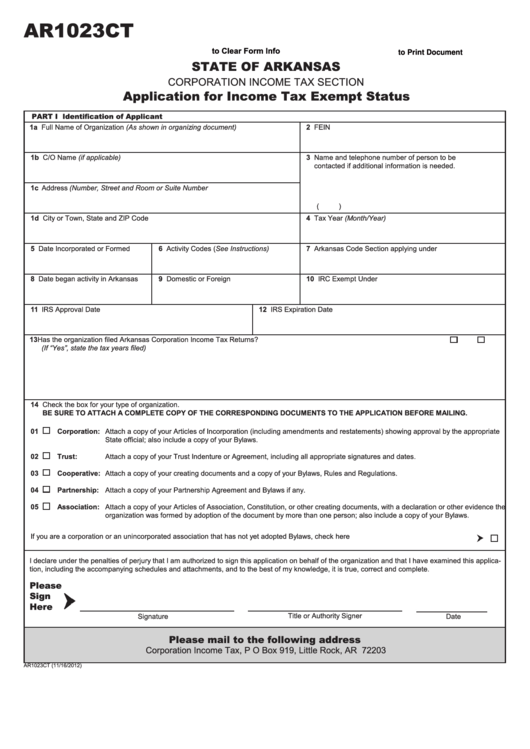

AR1023CT

Click Here to Clear Form Info

Click Here to Print Document

STATE OF ARKANSAS

CORPORATION INCOME TAX SECTION

Application for Income Tax Exempt Status

PART I

Identification of Applicant

1a Full Name of Organization (As shown in organizing document)

2 FEIN

1b C/O Name (if applicable)

3 Name and telephone number of person to be

contacted if additional information is needed.

1c Address (Number, Street and Room or Suite Number

(

)

1d City or Town, State and ZIP Code

4 Tax Year (Month/Year)

5 Date Incorporated or Formed

6 Activity Codes (See Instructions)

7 Arkansas Code Section applying under

8 Date began activity in Arkansas

9 Domestic or Foreign

10 IRC Exempt Under

11 IRS Approval Date

12 IRS Expiration Date

13 Has the organization filed Arkansas Corporation Income Tax Returns? ................................................................................................

Yes

No

(If “Yes”, state the tax years filed)

14 Check the box for your type of organization.

BE SURE TO ATTACH A COMPLETE COPY OF THE CORRESPONDING DOCUMENTS TO THE APPLICATION BEFORE MAILING.

01

Corporation:

Attach a copy of your Articles of Incorporation (including amendments and restatements) showing approval by the appropriate

State official; also include a copy of your Bylaws.

02

Trust:

Attach a copy of your Trust Indenture or Agreement, including all appropriate signatures and dates.

03

Cooperative:

Attach a copy of your creating documents and a copy of your Bylaws, Rules and Regulations.

04

Partnership:

Attach a copy of your Partnership Agreement and Bylaws if any.

05

Association:

Attach a copy of your Articles of Association, Constitution, or other creating documents, with a declaration or other evidence the

organization was formed by adoption of the document by more than one person; also include a copy of your Bylaws.

If you are a corporation or an unincorporated association that has not yet adopted Bylaws, check here .................................................................

I declare under the penalties of perjury that I am authorized to sign this application on behalf of the organization and that I have examined this applica-

tion, including the accompanying schedules and attachments, and to the best of my knowledge, it is true, correct and complete.

Please

Sign

Here

Title or Authority Signer

Signature

Date

Please mail to the following address

Corporation Income Tax, P O Box 919, Little Rock, AR 72203

AR1023CT (11/16/2012)

1

1 2

2