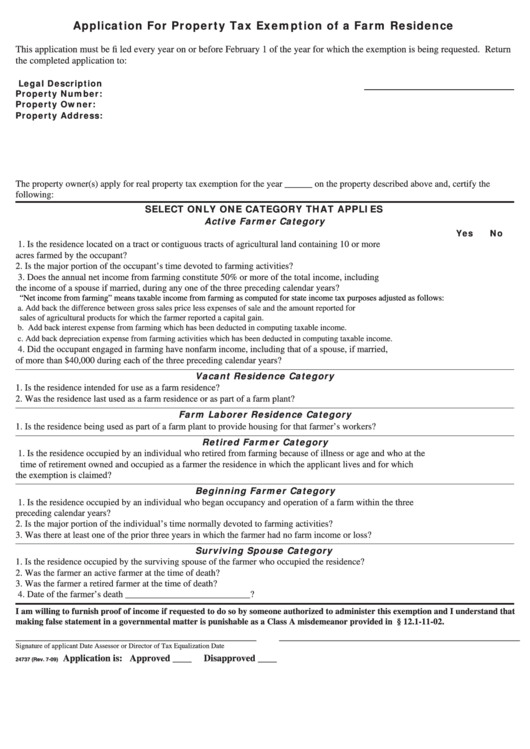

Application For Property Tax Exemption of a Farm Residence

This application must be fi led every year on or before February 1 of the year for which the exemption is being requested. Return

the completed application to:

Legal Description

Property Number:

Property Owner:

Property Address:

The property owner(s) apply for real property tax exemption for the year ______ on the property described above and, certify the

following:

SELECT ONLY ONE CATEGORY THAT APPLIES

Active Farmer Category

Yes

No

1. Is the residence located on a tract or contiguous tracts of agricultural land containing 10 or more

acres farmed by the occupant? ........................................................................................................................................ ____

____

2. Is the major portion of the occupant’s time devoted to farming activities? .................................................................... ____

____

3. Does the annual net income from farming constitute 50% or more of the total income, including

the income of a spouse if married, during any one of the three preceding calendar years? ........................................... ____

____

“Net income from farming” means taxable income from farming as computed for state income tax purposes adjusted as follows:

a. Add back the difference between gross sales price less expenses of sale and the amount reported for

sales of agricultural products for which the farmer reported a capital gain.

b. Add back interest expense from farming which has been deducted in computing taxable income.

c. Add back depreciation expense from farming activities which has been deducted in computing taxable income.

4. Did the occupant engaged in farming have nonfarm income, including that of a spouse, if married,

of more than $40,000 during each of the three preceding calendar years? ..................................................................... ____

____

Vacant Residence Category

1. Is the residence intended for use as a farm residence? ................................................................................................... ____

____

2. Was the residence last used as a farm residence or as part of a farm plant? ................................................................... ____

____

Farm Laborer Residence Category

1. Is the residence being used as part of a farm plant to provide housing for that farmer’s workers? ................................ ____

____

Retired Farmer Category

1. Is the residence occupied by an individual who retired from farming because of illness or age and who at the

time of retirement owned and occupied as a farmer the residence in which the applicant lives and for which

the exemption is claimed? ............................................................................................................................................... ____

____

Beginning Farmer Category

1. Is the residence occupied by an individual who began occupancy and operation of a farm within the three

preceding calendar years? ............................................................................................................................................... ____

____

2. Is the major portion of the individual’s time normally devoted to farming activities? ................................................... ____

____

3. Was there at least one of the prior three years in which the farmer had no farm income or loss? .................................. ____

____

Surviving Spouse Category

1. Is the residence occupied by the surviving spouse of the farmer who occupied the residence?..................................... ____

____

2. Was the farmer an active farmer at the time of death? .................................................................................................... ____

____

3. Was the farmer a retired farmer at the time of death? ..................................................................................................... ____

____

4. Date of the farmer’s death ___________________________?

I am willing to furnish proof of income if requested to do so by someone authorized to administer this exemption and I understand that

making false statement in a governmental matter is punishable as a Class A misdemeanor provided in N.D.C.C. § 12.1-11-02.

_______________________________________________________

_______________________________________________________

Signature of applicant

Date

Assessor or Director of Tax Equalization

Date

Application is: Approved ____

Disapproved ____

24737 (Rev. 7-09)

1

1 2

2