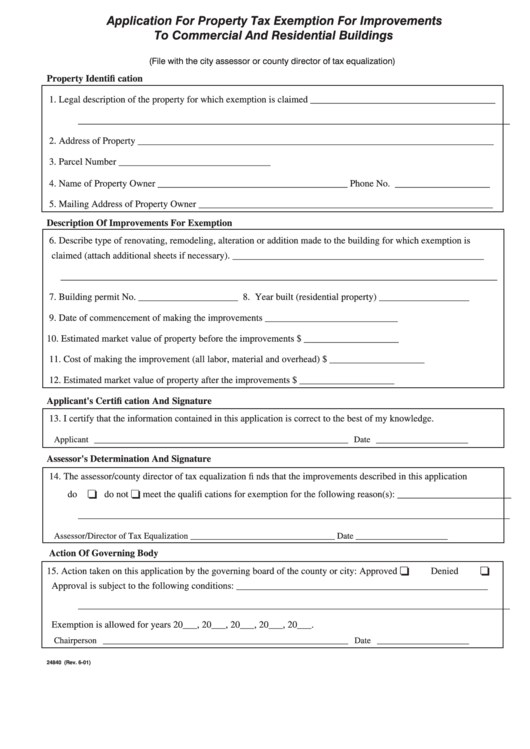

Application For Property Tax Exemption For Improvements

To Commercial And Residential Buildings

N.D.C.C. ch. 57-02.2

(File with the city assessor or county director of tax equalization)

Property Identifi cation

1. Legal description of the property for which exemption is claimed _______________________________________

___________________________________________________________________________________________

2. Address of Property ___________________________________________________________________________

3. Parcel Number ________________________________

4. Name of Property Owner ________________________________________ Phone No. ____________________

5. Mailing Address of Property Owner ______________________________________________________________

Description Of Improvements For Exemption

6. Describe type of renovating, remodeling, alteration or addition made to the building for which exemption is

claimed (attach additional sheets if necessary). _____________________________________________________

____________________________________________________________________________________________

7. Building permit No. _____________________

8. Year built (residential property) ___________________

9. Date of commencement of making the improvements ____________________________

10. Estimated market value of property before the improvements

$ ____________________

11. Cost of making the improvement (all labor, material and overhead) $ ____________________

12. Estimated market value of property after the improvements

$ ____________________

Applicant's Certifi cation And Signature

13. I certify that the information contained in this application is correct to the best of my knowledge.

Applicant __________________________________________________________

Date

_____________________

Assessor's Determination And Signature

14. The assessor/county director of tax equalization fi nds that the improvements described in this application

do

do not

meet the qualifi cations for exemption for the following reason(s): ________________________

___________________________________________________________________________________________

Assessor/Director of Tax Equalization

_________________________________

Date

_____________________

Action Of Governing Body

15. Action taken on this application by the governing board of the county or city:

Approved

Denied

Approval is subject to the following conditions: _____________________________________________________

___________________________________________________________________________________________

Exemption is allowed for years 20___, 20___, 20___, 20___, 20___.

Chairperson ________________________________________________________

Date

_____________________

24840 (Rev. 6-01)

1

1