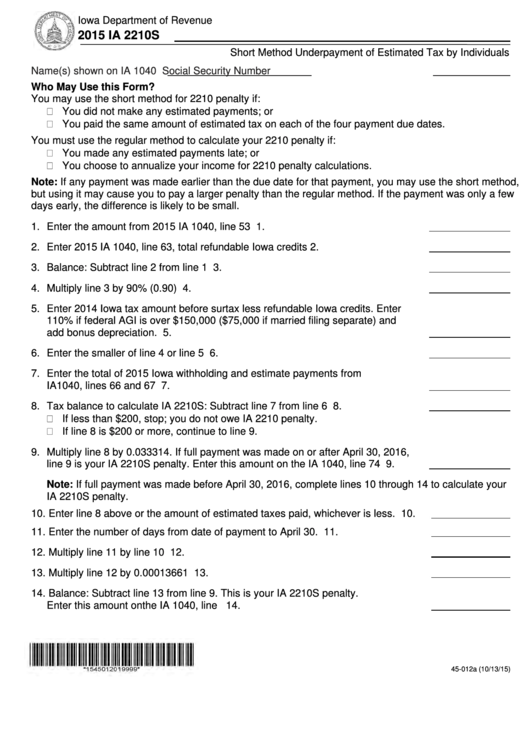

Iowa Department of Revenue

2015 IA 2210S

https://tax.iowa.gov

Short Method Underpayment of Estimated Tax by Individuals

Name(s) shown on IA 1040

Social Security Number

Who May Use this Form?

You may use the short method for 2210 penalty if:

You did not make any estimated payments; or

You paid the same amount of estimated tax on each of the four payment due dates.

You must use the regular method to calculate your 2210 penalty if:

You made any estimated payments late; or

You choose to annualize your income for 2210 penalty calculations.

Note: If any payment was made earlier than the due date for that payment, you may use the short method,

but using it may cause you to pay a larger penalty than the regular method. If the payment was only a few

days early, the difference is likely to be small.

1. Enter the amount from 2015 IA 1040, line 53 ......................................................... 1.

2. Enter 2015 IA 1040, line 63, total refundable Iowa credits...................................... 2.

3. Balance: Subtract line 2 from line 1 ........................................................................ 3.

4. Multiply line 3 by 90% (0.90) ................................................................................... 4.

5. Enter 2014 Iowa tax amount before surtax less refundable Iowa credits. Enter

110% if federal AGI is over $150,000 ($75,000 if married filing separate) and

add bonus depreciation. ......................................................................................... 5.

6. Enter the smaller of line 4 or line 5 ......................................................................... 6.

7. Enter the total of 2015 Iowa withholding and estimate payments from

IA1040, lines 66 and 67 .......................................................................................... 7.

8. Tax balance to calculate IA 2210S: Subtract line 7 from line 6 ............................... 8.

If less than $200, stop; you do not owe IA 2210 penalty.

If line 8 is $200 or more, continue to line 9.

9. Multiply line 8 by 0.033314. If full payment was made on or after April 30, 2016,

line 9 is your IA 2210S penalty. Enter this amount on the IA 1040, line 74 ............ 9.

Note: If full payment was made before April 30, 2016, complete lines 10 through 14 to calculate your

IA 2210S penalty.

10. Enter line 8 above or the amount of estimated taxes paid, whichever is less. ....... 10.

11. Enter the number of days from date of payment to April 30. .................................. 11.

12. Multiply line 11 by line 10 ....................................................................................... 12.

13. Multiply line 12 by 0.00013661 .............................................................................. 13.

14. Balance: Subtract line 13 from line 9. This is your IA 2210S penalty.

Enter this amount on the IA 1040, line 74... ........................................................... 14.

45-012a (10/13/15)

1

1 2

2