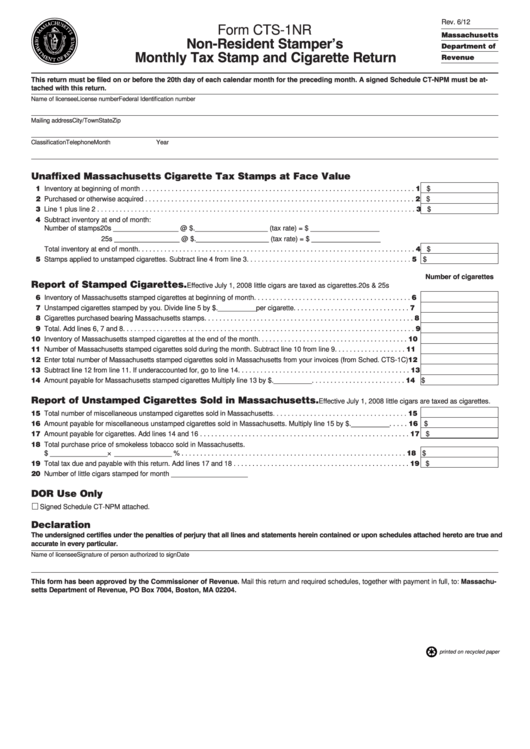

Rev. 6/12

Form CTS-1NR

Massachusetts

Non-Resident Stamper’s

Department of

Monthly Tax Stamp and Cigarette Return

Revenue

This return must be filed on or before the 20th day of each calendar month for the preceding month. A signed Schedule CT-NPM must be at-

tached with this return.

Name of licensee

License number

Federal Identification number

Mailing address

City/Town

State

Zip

Classification

Telephone

Month

Year

Unaffixed Massachusetts Cigarette Tax Stamps at Face Value

11 Inventory at beginning of month . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 $

12 Purchased or otherwise acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 $

13 Line 1 plus line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 $

14 Subtract inventory at end of month:

Number of stamps 20s _________________ @ $. ___________________ (tax rate) = $ __________________

25s _________________ @ $. ___________________ (tax rate) = $ __________________

Total inventory at end of month. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 $

15 Stamps applied to unstamped cigarettes. Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 $

Number of cigarettes

Report of Stamped Cigarettes.

Effective July 1, 2008 little cigars are taxed as cigarettes.

20s & 25s

16 Inventory of Massachusetts stamped cigarettes at beginning of month . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Unstamped cigarettes stamped by you. Divide line 5 by $.__________ per cigarette . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Cigarettes purchased bearing Massachusetts stamps. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Total. Add lines 6, 7 and 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Inventory of Massachusetts stamped cigarettes at the end of the month . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Number of Massachusetts stamped cigarettes sold during the month. Subtract line 10 from line 9 . . . . . . . . . . . . . . . . . . . 11

12 Enter total number of Massachusetts stamped cigarettes sold in Massachusetts from your invoices (from Sched. CTS-1C) 12

13 Subtract line 12 from line 11. If underaccounted for, go to line 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Amount payable for Massachusetts stamped cigarettes Multiply line 13 by $. __________ . . . . . . . . . . . . . . . . . . . . . . . . . 14 $

Report of Unstamped Cigarettes Sold in Massachusetts.

Effective July 1, 2008 little cigars are taxed as cigarettes.

15 Total number of miscellaneous unstamped cigarettes sold in Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Amount payable for miscellaneous unstamped cigarettes sold in Massachusetts. Multiply line 15 by $. __________ . . . . . 16 $

17 Amount payable for cigarettes. Add lines 14 and 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 $

18 Total purchase price of smokeless tobacco sold in Massachusetts.

$ _______________ × _______________ % . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 $

19 Total tax due and payable with this return. Add lines 17 and 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 $

20 Number of little cigars stamped for month ____________________

DOR Use Only

Signed Schedule CT-NPM attached.

Declaration

The undersigned certifies under the penalties of perjury that all lines and statements herein contained or upon schedules attached hereto are true and

accurate in every particular.

Name of licensee

Signature of person authorized to sign

Date

This form has been approved by the Commissioner of Revenue. Mail this return and required schedules, together with payment in full, to: Massachu-

setts Department of Revenue, PO Box 7004, Boston, MA 02204.

printed on recycled paper

1

1