Form St-45 - Non-Resident Contractor'S Bond

ADVERTISEMENT

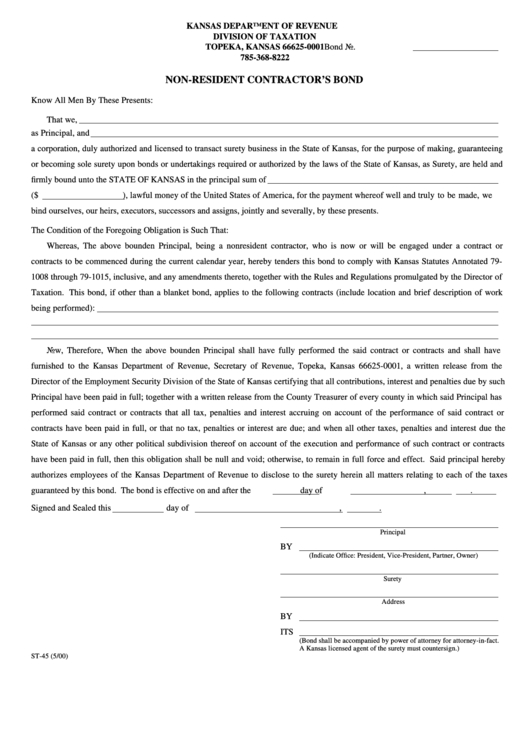

KANSAS DEPARTMENT OF REVENUE

DIVISION OF TAXATION

TOPEKA, KANSAS 66625-0001

Bond No.

785-368-8222

NON-RESIDENT CONTRACTOR’S BOND

Know All Men By These Presents:

That we,

as Principal, and

a corporation, duly authorized and licensed to transact surety business in the State of Kansas, for the purpose of making, guaranteeing

or becoming sole surety upon bonds or undertakings required or authorized by the laws of the State of Kansas, as Surety, are held and

firmly bound unto the STATE OF KANSAS in the principal sum of

($

), lawful money of the United States of America, for the payment whereof well and truly to be made, we

bind ourselves, our heirs, executors, successors and assigns, jointly and severally, by these presents.

The Condition of the Foregoing Obligation is Such That:

Whereas, The above bounden Principal, being a nonresident contractor, who is now or will be engaged under a contract or

contracts to be commenced during the current calendar year, hereby tenders this bond to comply with Kansas Statutes Annotated 79-

1008 through 79-1015, inclusive, and any amendments thereto, together with the Rules and Regulations promulgated by the Directo r of

Taxation. This bond, if other than a blanket bond, applies to the following contracts (include location and brief description of work

being performed):

Now, Therefore, When the above bounden Principal shall have fully performed the said contract or contracts and shall have

furnished to the Kansas Department of Revenue, Secretary of Revenue, Topeka, Kansas 66625-0001, a written release from the

Director of the Employment Security Division of the State of Kansas certifying that all contributions, interest and penalties due by such

Principal have been paid in full; together with a written release from the County Treasurer of every county in which said Principal has

performed said contract or contracts that all tax, penalties and interest accruing on account of the performance of said contract or

contracts have been paid in full, or that no tax, penalties or interest are due; and when all other taxes, penalties and interest due the

State of Kansas or any other political subdivision thereof on account of the execution and performance of such contract or contracts

have been paid in full, then this obligation shall be null and void; otherwise, to remain in full force and effect. Said principal hereby

authorizes employees of the Kansas Department of Revenue to disclose to the surety herein all matters relating to each of the taxes

guaranteed by this bond. The bond is effective on and after the

day of

,

.

Signed and Sealed this

day of

,

.

Principal

BY

(Indicate Office: President, Vice-President, Partner, Owner)

Surety

Address

BY

ITS

(Bond shall be accompanied by power of attorney for attorney-in-fact.

A Kansas licensed agent of the surety must countersign.)

ST-45 (5/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1