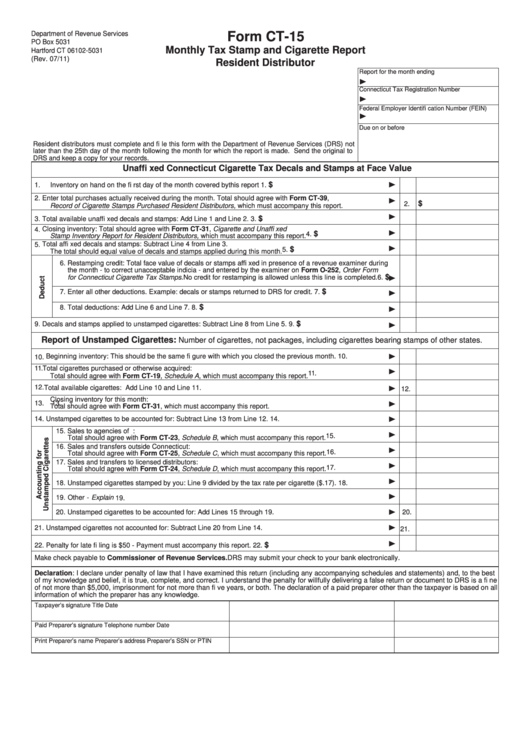

Department of Revenue Services

Form CT-15

PO Box 5031

Monthly Tax Stamp and Cigarette Report

Hartford CT 06102-5031

(Rev. 07/11)

Resident Distributor

Report for the month ending

Connecticut Tax Registration Number

Federal Employer Identifi cation Number (FEIN)

Due on or before

Resident distributors must complete and fi le this form with the Department of Revenue Services (DRS) not

later than the 25th day of the month following the month for which the report is made. Send the original to

DRS and keep a copy for your records.

Unaffi xed Connecticut Cigarette Tax Decals and Stamps at Face Value

$

1.

Inventory on hand on the fi rst day of the month covered by this report

1.

2.

Enter total purchases actually received during the month. Total should agree with Form CT-39,

$

2.

Record of Cigarette Stamps Purchased Resident Distributors, which must accompany this report.

$

3.

Total available unaffi xed decals and stamps: Add Line 1 and Line 2.

3.

Closing inventory: Total should agree with Form CT-31, Cigarette and Unaffi xed

4.

$

4.

Stamp Inventory Report for Resident Distributors, which must accompany this report.

Total affi xed decals and stamps: Subtract Line 4 from Line 3.

5.

$

5.

The total should equal value of decals and stamps applied during this month.

6. Restamping credit: Total face value of decals or stamps affi xed in presence of a revenue examiner during

the month - to correct unacceptable indicia - and entered by the examiner on Form O-252, Order Form

$

for Connecticut Cigarette Tax Stamps. No credit for restamping is allowed unless this line is completed.

6.

$

7. Enter all other deductions. Example: decals or stamps returned to DRS for credit.

7.

$

8. Total deductions: Add Line 6 and Line 7.

8.

$

9.

Decals and stamps applied to unstamped cigarettes: Subtract Line 8 from Line 5.

9.

Report of Unstamped Cigarettes:

Number of cigarettes, not packages, including cigarettes bearing stamps of other states.

10. Beginning inventory: This should be the same fi gure with which you closed the previous month.

10.

11. Total cigarettes purchased or otherwise acquired:

11.

Total should agree with Form CT-19, Schedule A, which must accompany this report.

12. Total available cigarettes: Add Line 10 and Line 11.

12.

Closing inventory for this month:

13.

13.

Total should agree with Form CT-31, which must accompany this report.

14. Unstamped cigarettes to be accounted for: Subtract Line 13 from Line 12.

14.

15. Sales to agencies of U.S. and Connecticut:

15.

Total should agree with Form CT-23, Schedule B, which must accompany this report.

16. Sales and transfers outside Connecticut:

16.

Total should agree with Form CT-25, Schedule C, which must accompany this report.

17. Sales and transfers to licensed distributors:

17.

Total should agree with Form CT-24, Schedule D, which must accompany this report.

18. Unstamped cigarettes stamped by you: Line 9 divided by the tax rate per cigarette ($.17).

18.

19. Other - Explain

19.

20. Unstamped cigarettes to be accounted for: Add Lines 15 through 19.

20.

21. Unstamped cigarettes not accounted for: Subtract Line 20 from Line 14.

21.

$

22. Penalty for late fi ling is $50 - Payment must accompany this report.

22.

Make check payable to Commissioner of Revenue Services. DRS may submit your check to your bank electronically.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best

of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fi ne

of not more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all

information of which the preparer has any knowledge.

Taxpayer’s signature

Title

Date

Paid Preparer’s signature

Telephone number

Date

Print Preparer’s name

Preparer’s address

Preparer’s SSN or PTIN

1

1 2

2