SECTION C: Sales Factor

Within the NIZ – Total sales in the NIZ during the tax period. Sales of tangible personal property are consid-

ered in the NIZ if the property is delivered or shipped to a purchaser that takes possession within the NIZ,

regardless of the FOB point or other conditions of the sale. Sales, other than sales of tangible personal prop-

erty, are in the NIZ if:

1. The income-producing activity is performed in the NIZ; or

2. The income-producing activity is performed within and outside the NIZ, and a greater proportion of

the income-producing activity is performed in the NIZ than in any other location, based on costs of

performance.

Within PA – All sales sourced to locations inside PA. This includes all sales destined to locations inside PA plus

sales of goods picked-up by customers in the NIZ, either in their own vehicles or by common carriers arranged

for by the customers and transported to locations outside the commonwealth. Since the sourcing of sales

picked-up in the NIZ and transported outside the commonwealth is different for the calculation of the credit

than the rules for sourcing these sales in the calculation of the three-factor apportionment, this may not equal

the sales reported inside PA on Table 3 of the Tables Supporting Determination of Apportionment Percentage,

form RCT-106.

SECTION D: Total Apportionment

Add the three factors from Sections A, B and C.

SECTION E: Calculation of Tax Percentage

Divide the Total Apportionment by 3.

SECTION F: NIZ Tax Liability

Multiply the Total Tax Payments remitted to the department during the calendar year from Sections A, B and

C by the Tax Percentage from Section D. This is the NIZ Tax Liability to be applied on a quarterly basis on the

NIZ Corporation Tax Statement.

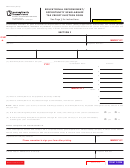

EXAMPLE

Property In NIZ

10

A. PROPERTY FACTOR

=

0.100000

PA Property

100

Payroll In NIZ

20

B. PAYROLL FACTOR

=

0.200000

PA Payroll

100

Sales In NIZ

5

C. SALES FACTOR

=

0.050000

PA Sales

100

D. TOTAL APPORTIONMENT

0.350000

E. TAX PERCENTAGE

0.350000 / 3

=

0.116667

Tax $1,000 X 0.116667

=

$ 117

F. NIZ TAX LIABILITY

If the Pennsylvania corporate tax payments made total $1,000,

the NIZ corporate tax liability is $117, or 1,000 X 0.116667.

1

1 2

2 3

3