Form Ct-Irf - Insurance Reinvestment Fund Tax Credit Page 2

ADVERTISEMENT

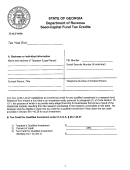

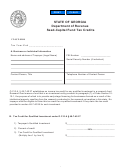

Part II - Computation of Carryforward

- Credit may be carried forward to fi ve succeeding income years. See instructions below.

A

B

C

D

E

Total

Credit

Carryforward to 2015

Credit

Carryforward

Credit

Applied

Subtract Column B

Applied

to

Earned

2010 Through 2014

from Column A.

to 2015

2016

2010 Insurance

Reinvestment Fund tax

1.

credit from 2010 Form

CT-IRF, Part I, Line 4

2011 Insurance

Reinvestment Fund tax

2.

credit from 2011 Form

CT-IRF, Part I, Line 4

2012 Insurance

Reinvestment Fund tax

3.

credit from 2012 Form

CT-IRF, Part I, Line 4

2013 Insurance

Reinvestment Fund tax

4.

credit from 2013 Form

CT-IRF, Part I, Line 4

2014 Insurance

Reinvestment Fund tax

5.

credit from 2014 Form

CT-IRF, Part I, Line 4

2015 Insurance

Reinvestment Fund tax

6.

credit from 2015 Form

CT-IRF, Part I, Line 4

Total Insurance Reinvestment Fund tax credit applied to 2015: Add Lines 1 through 6,

Column D. Enter amount applied to business taxes here and on Form CT-1120K, Part I-C,

7.

Column C or Column D and/or Form CT-207K, Part 3A, Column C.

Total Insurance Reinvestment Fund tax credit carryforward to 2016: Add Lines 2 through 6, Column E.

8.

Enter here and on Form CT-1120K, Part I-C, Column E or Form CT-207K, Part 3A, Column D.

Computation of Carryforward Instructions:

Lines 1 through 6, Columns A through D - Enter the amount for each corresponding year.

Lines 2 through 5, Column E - Subtract Column D from Column C.

Line 6, Column E - Subtract Column D from Column A.

Form CT-IRF Back (Rev. 12/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2