Form Ct-207k - Insurance/health Care Tax Credit Schedule - 2014

ADVERTISEMENT

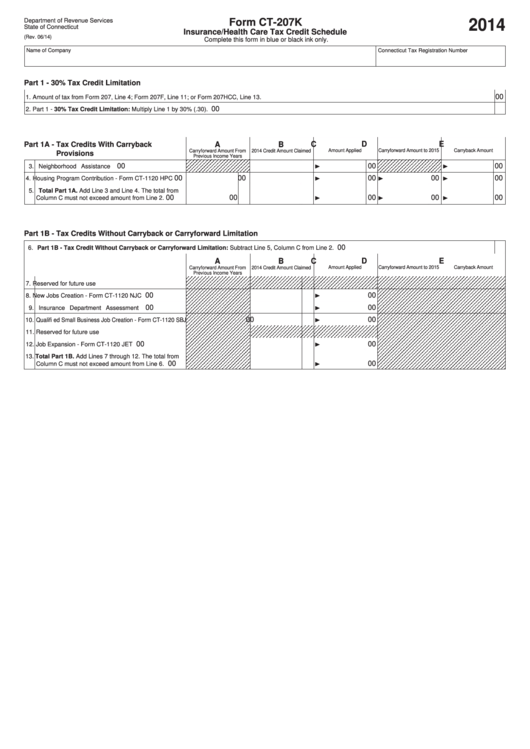

Department of Revenue Services

Form CT-207K

2014

State of Connecticut

Insurance/Health Care Tax Credit Schedule

(Rev. 06/14)

Complete this form in blue or black ink only.

Name of Company

Connecticut Tax Registration Number

Part 1 - 30% Tax Credit Limitation

00

1. Amount of tax from Form 207, Line 4; Form 207F, Line 11; or Form 207HCC, Line 13.

00

2. Part 1 - 30% Tax Credit Limitation: Multiply Line 1 by 30% (.30).

C

D

E

A

B

Part 1A - Tax Credits With Carryback

Amount Applied

Carryforward Amount to 2015

Carryback Amount

Carryforward Amount From

2014 Credit Amount Claimed

Provisions

Previous Income Years

00

00

00

3. Neighborhood Assistance

00

00

00

00

00

4. Housing Program Contribution - Form CT-1120 HPC

5. Total Part 1A. Add Line 3 and Line 4. The total from

00

00

00

00

00

Column C must not exceed amount from Line 2.

Part 1B - Tax Credits Without Carryback or Carryforward Limitation

00

6. Part 1B - Tax Credit Without Carryback or Carryforward Limitation: Subtract Line 5, Column C from Line 2.

A

B

C

D

E

Carryforward Amount From

2014 Credit Amount Claimed

Amount Applied

Carryforward Amount to 2015

Carryback Amount

Previous Income Years

7. Reserved for future use

00

00

8. New Jobs Creation - Form CT-1120 NJC

00

00

9. Insurance Department Assessment

00

00

10. Qualifi ed Small Business Job Creation - Form CT-1120 SBJ

11. Reserved for future use

00

00

12. Job Expansion - Form CT-1120 JET

13. Total Part 1B. Add Lines 7 through 12. The total from

00

00

Column C must not exceed amount from Line 6.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3