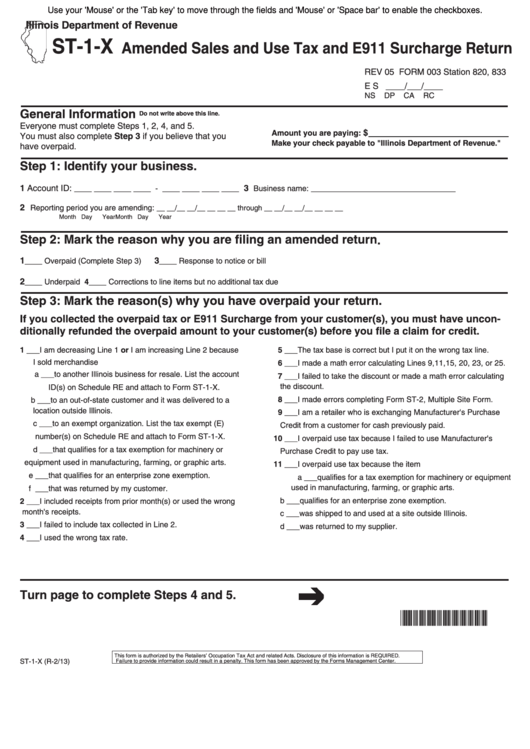

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-1-X

Amended Sales and Use Tax and E911 Surcharge Return

REV 05 FORM 003 Station 820, 833

E S ____/___/____

NS

DP

CA

RC

General Information

Do not write above this line.

Everyone must complete Steps 1, 2, 4, and 5.

$

Amount you are paying:

You must also complete Step 3 if you believe that you

Make your check payable to "Illinois Department of Revenue."

have overpaid.

Step 1: Identify your business.

1 Account ID:

3

____ ____ ____ ____ - ____ ____ ____ ____

Business name: _________________________________

2

Reporting period you are amending:

__ __/__ __/__ __ __ __ through __ __/__ __/__ __ __ __

Month Day

Year

Month Day

Year

Step 2: Mark the reason why you are filing an amended return .

1

3

____ Overpaid (Complete Step 3)

____ Response to notice or bill

2

____ Underpaid

4____ Corrections to line items but no additional tax due

Step 3: Mark the reason(s) why you have overpaid your return.

If you collected the overpaid tax or E911 Surcharge from your customer(s), you must have uncon-

ditionally refunded the overpaid amount to your customer(s) before you file a claim for credit.

1 ___I am decreasing Line 1 or I am increasing Line 2 because

5 ___The tax base is correct but I put it on the wrong tax line.

I sold merchandise

6 ___I made a math error calculating Lines 9,11,15, 20, 23, or 25.

a ___to another Illinois business for resale. List the account

7 ___I failed to take the discount or made a math error calculating

the discount.

ID(s) on Schedule RE and attach to Form ST-1-X.

8 ___I made errors completing Form ST-2, Multiple Site Form.

b ___to an out-of-state customer and it was delivered to a

location outside Illinois.

9 ___I am a retailer who is exchanging Manufacturer's Purchase

c ___to an exempt organization. List the tax exempt (E)

Credit from a customer for cash previously paid.

number(s) on Schedule RE and attach to Form ST-1-X.

10 ___I overpaid use tax because I failed to use Manufacturer's

d ___that qualifies for a tax exemption for machinery or

Purchase Credit to pay use tax.

equipment used in manufacturing, farming, or graphic arts.

11 ___I overpaid use tax because the item

e ___that qualifies for an enterprise zone exemption.

a ___qualifies for a tax exemption for machinery or equipment

used in manufacturing, farming, or graphic arts.

f ___that was returned by my customer.

b ___qualifies for an enterprise zone exemption.

2 ___I included receipts from prior month(s) or used the wrong

month's receipts.

c ___was shipped to and used at a site outside Illinois.

3 ___I failed to include tax collected in Line 2.

d ___was returned to my supplier.

4 ___I used the wrong tax rate.

Turn page to complete Steps 4 and 5.

*300301110*

This form is authorized by the Retailers’ Occupation Tax Act and related Acts. Disclosure of this information is REQUIRED.

ST-1-X (R-2/13)

Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center.

1

1 2

2 3

3 4

4