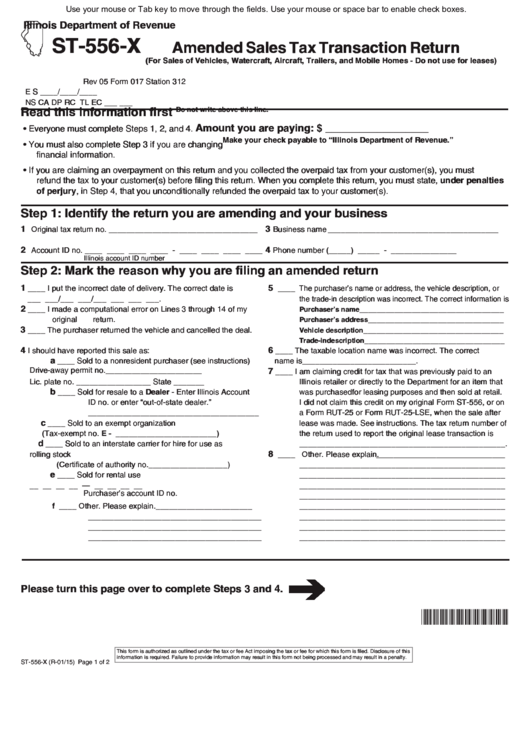

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

ST-556-X

Amended Sales Tax Transaction Return

(For Sales of Vehicles, Watercraft, Aircraft, Trailers, and Mobile Homes - Do not use for leases)

Rev 05 Form 017 Station 312

E S

____/____/____

NS CA DP RC TL EC ___ ___

Read this information first

Do not write above this line.

Amount you are paying: $ __________________

•

Everyone must complete Steps 1, 2, and 4.

Make your check payable to “Illinois Department of Revenue.”

•

You must also complete Step 3 if you are changing

financial information.

•

If you are claiming an overpayment on this return and you collected the overpaid tax from your customer(s), you must

refund the tax to your customer(s) before filing this return. When you complete this return, you must state, under penalties

of perjury, in Step 4, that you unconditionally refunded the overpaid tax to your customer(s).

Step 1: Identify the return you are amending and your business

1

3

Original tax return no. __________________________________

Business name _______________________________________

2

4

Account ID no. ____ ____ ____ ____ - ____ ____ ____ ____

Phone number (_____) _____ - _______________

Illinois account ID number

Step 2: Mark the reason why you are filing an amended return

1

5

____ I put the incorrect date of delivery. The correct date is

____ The purchaser’s name or address, the vehicle description, or

___ ___/___ ___/___ ___ ___ ___.

the trade-in description was incorrect. The correct information is

2

____ I made a computational error on Lines 3 through 14 of my

_________________________________

Purchaser’s name

original return.

_______________________________

Purchaser’s address

3

____ The purchaser returned the vehicle and cancelled the deal.

________________________________

Vehicle description

________________________________

Trade-in description

4

6

I should have reported this sale as:

____ The taxable location name was incorrect. The correct

a

____

Sold to a nonresident purchaser (see instructions)

name is__________________________.

7

Drive-away permit no.______________________

____ I am claiming credit for tax that was previously paid to an

Lic. plate no. _________________ State _______

Illinois retailer or directly to the Department for an item that

b

____

Sold for resale to a Dealer - Enter Illinois Account

was purchased for leasing purposes and then sold at retail.

ID no. or enter “out-of-state dealer.”

I did not claim this credit on my original Form ST-556, or on

_______________________________________

a Form RUT-25 or Form RUT-25-LSE, when the sale after

c

____

Sold to an exempt organization

lease was made. See instructions. The tax return number of

(Tax-exempt no. E - _______________________)

the return used to report the original lease transaction is

d

____

Sold to an interstate carrier for hire for use as

_______________________________________________.

8

rolling stock

____ Other. Please explain. ______________________________

(Certificate of authority no.__________________)

_______________________________________________

e

____

Sold for rental use

_______________________________________________

__ __ __ __ — __ __ __ __

_______________________________________________

Purchaser’s account ID no.

_______________________________________________

f ____

Other. Please explain.______________________

_______________________________________________

________________________________________

_______________________________________________

________________________________________

_______________________________________________

________________________________________

_______________________________________________

Please turn this page over to complete Steps 3 and 4.

*501751110*

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this

information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

ST-556-X (R-01/15)

Page 1 of 2

1

1 2

2