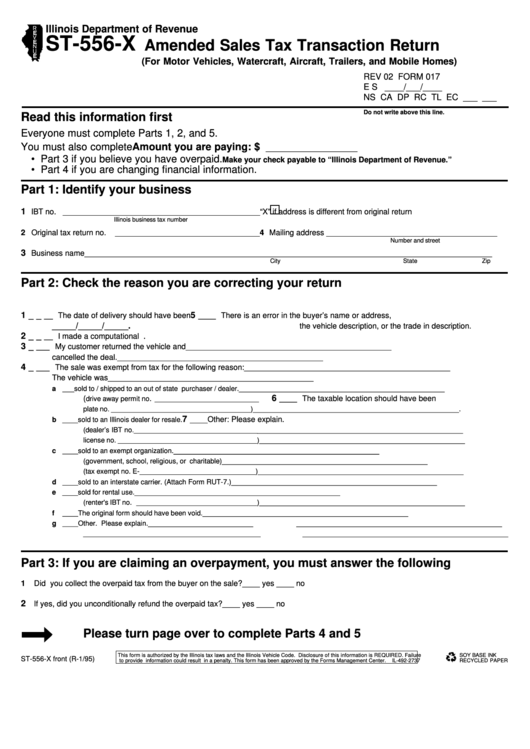

Illinois Department of Revenue

ST-556-X

Amended Sales Tax Transaction Return

(For Motor Vehicles, Watercraft, Aircraft, Trailers, and Mobile Homes)

REV 02 FORM 017

E S ____/___/____

NS CA DP RC TL EC ___ ___

Do not write above this line.

Read this information first

Everyone must complete Parts 1, 2, and 5.

You must also complete

Amount you are paying: $ ________________

• Part 3 if you believe you have overpaid.

Make your check payable to “Illinois Department of Revenue.”

• Part 4 if you are changing financial information.

Part 1: Identify your business

1

IBT no. _____________________________________________

“X” if address is different from original return

Illinois business tax number

2 Original tax return no.

_________________________________

4 Mailing address _______________________________________

Number and street

3

Business name _______________________________________

______________________________________________________

City

State

Zip

Part 2: Check the reason you are correcting your return

1 __

5

__ The date of delivery should have been

____ There is an error in the buyer’s name or address,

_____/_____/_____.

the vehicle description, or the trade in description.

2 __

.

__ I made a computational error.

Write the correct information here

3 _

___ My customer returned the vehicle and

_______________________________________________

cancelled the deal.

_______________________________________________

4 _

___ The sale was exempt from tax for the following reason:

_______________________________________________

The vehicle was

_______________________________________________

_______________________________________________

a ___

sold to / shipped to an out of state purchaser / dealer.

6

(

.

____ The taxable location should have been

drive away permit no

___________________________

_______________________________________________.

plate no.

____________________________________)

7

____ Other: Please explain.

b ____ sold to an Illinois dealer for resale.

_______________________________________________

(dealer’s IBT no. ________________________________

_______________________________________________

license no. ____________________________________)

_______________________________________________

c ____ sold to an exempt organization.

_______________________________________________

(government, school, religious, or charitable)

_______________________________________________

(tax exempt no. E- ______________________________)

_______________________________________________

d ____ sold to an interstate carrier. (Attach Form RUT-7.)

_______________________________________________

e ____ sold for rental use.

_______________________________________________

(renter's IBT no. _______________________________)

_______________________________________________

f

____ The original form should have been void.

________________________

_______________________________________________

g ____ Other. Please explain.

_______________________________________________

______________________________________________

Part 3: If you are claiming an overpayment, you must answer the following

1

Did you collect the overpaid tax from the buyer on the sale?

____ yes ____ no

2

If yes, did you unconditionally refund the overpaid tax?

____ yes ____ no

Please turn page over to complete Parts 4 and 5

This form is authorized by the Illinois tax laws and the Illinois Vehicle Code. Disclosure of this information is REQUIRED. Failure

SOY BASE INK

ST-556-X front (R-1/95)

to provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2737

RECYCLED PAPER

1

1 2

2