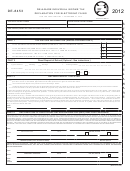

Instructions for Form MI-8453

2012 MI-8453, Page 2

Michigan Individual Income Tax Declaration for e-file

Purpose

Volunteer Groups

Form MI-8453 is the declaration and signature document for a

If taxpayers complete Form MI-8453, it should be mailed to

State Stand-Alone (unlinked) return. If you e-file your federal

Treasury. Treasury recommends collecting all MI-8453 forms

and Michigan returns, Michigan will accept the federal signature

and at the end of the filing season sending them to Treasury.

(PIN). If you e-file a State Stand-Alone return the Electronic

Volunteer preparers may provide taxpayers with their Form

Signature Alternative (ESA) or paper Form MI-8453 must be used

MI-8453 instructing them to mail it to Treasury. If located in a

to sign your return. If you use the ESA to sign your return, you

permanent facility, volunteer preparers may retain Form MI-8453

do not need to complete Form MI-8453.

on file, the same as a paid preparer.

You must complete your Michigan Individual Income Tax

Taxpayer Responsibilities

Return (Form MI-1040) before completing Form MI-8453. Form

MI-8453 must be completed before the taxpayer, electronic return

1. Verify the accuracy of the prepared MI-1040 return.

originator (ERO) or preparer signs it.

2. Sign and date Form MI-8453. Retain a copy of Form MI-8453

with their return.

ERO/Tax Preparer Responsibilities

3. When using a tax preparer, return the completed Form

1. Enter the name(s), address and Social Security number(s) of the

MI-8453 to the ERO by hand delivery, U.S. mail, private

taxpayer at the top of the form.

delivery service, or fax. The return will not be transmitted

2. Complete Part 1 using the amounts from the taxpayer’s 2012

until the ERO receives the signed Form MI-8453. Do not send

MI-1040.

Form MI-8453 to the Michigan Department of Treasury unless

requested to do so.

3. After completing Parts 1 and 3, provide the taxpayer with Form

MI-8453 for completion/review. This can be done in person, by

4. If filing your return online (not using a tax preparer) you must

U.S. mail, private delivery service, e-mail or Internet Web site.

mail Form MI-8453 to Treasury within three (3) business days

4. Provide the taxpayer with a copy of the completed Form

after receiving an acknowledgment from Michigan that the

e-file return has been accepted.

MI-8453 and all other information for the taxpayer’s records.

5. Sign the form using a rubber stamp, mechanical device, or

Mailing Address:

Michigan Department of Treasury

computer software program. The ERO must complete, sign

Michigan Electronic Filing Programs

and date the ERO declaration. An ERO who is also the preparer

P.O. Box 30679

must check the preparer box, but is not required to complete or

Lansing, MI 48909-8179

sign the preparer sections.

6. Preparers transmitting State Stand-Alone filings that do not use

the ESA must complete Form MI-8453. Do not send Form

MI-8453 to the Michigan Department of Treasury unless

requested to do so. Treasury recommends the preparer retain

a copy of Form MI-8453 for six years.

7. Issue a corrected Form MI-8453 after the taxpayer has signed

Form MI-8453 but before the return is transmitted when either

of the following applies:

a. The corrected federal adjusted gross income varies by

more than $25, or

b. The corrected refund varies by more than $5.

When and How to Complete

MI-8453 REQUIREMENT

FILING METHOD

The federal return was e-filed with the Michigan

Do not complete Form MI-8453.

return.

The federal return was previously e-filed and your

software allowed you to “link” your Michigan

Do not complete Form MI-8453.

return to a previously accepted federal return.

Correct the error on the Michigan return. Retransmit as a State Stand-Alone return if supported

The federal return was e-filed with the Michigan

by the software. If the return was not signed using the ESA, complete Form MI-8453, then see

return. The federal return was accepted but the

information above regarding mailing requirements. There is no limit on how many times the

Michigan return was rejected.

State Stand-Alone return can be corrected and re-transmitted.

If the return was not signed using the ESA, complete Form MI-8453, then see information above

E-filing a State Stand-Alone return.

regarding mailing requirements. There is no limit on how many times the State Stand-Alone

A federal return was not required.

return can be corrected and re-transmitted.

1

1 2

2