2013 Maine Income Tax Withholding - Annualized Percentage Method

ADVERTISEMENT

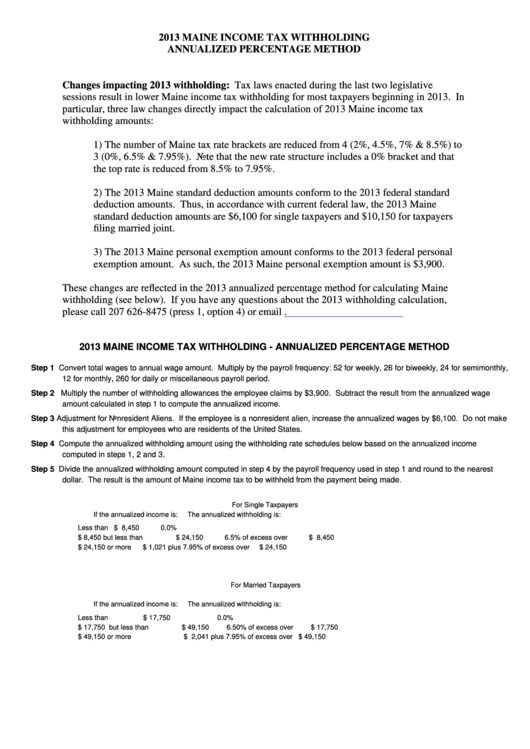

2013 MAINE INCOME TAX WITHHOLDING

ANNUALIZED PERCENTAGE METHOD

Changes impacting 2013 withholding: Tax laws enacted during the last two legislative

sessions result in lower Maine income tax withholding for most taxpayers beginning in 2013. In

particular, three law changes directly impact the calculation of 2013 Maine income tax

withholding amounts:

1) The number of Maine tax rate brackets are reduced from 4 (2%, 4.5%, 7% & 8.5%) to

3 (0%, 6.5% & 7.95%). Note that the new rate structure includes a 0% bracket and that

the top rate is reduced from 8.5% to 7.95%.

2) The 2013 Maine standard deduction amounts conform to the 2013 federal standard

deduction amounts. Thus, in accordance with current federal law, the 2013 Maine

standard deduction amounts are $6,100 for single taxpayers and $10,150 for taxpayers

filing married joint.

3) The 2013 Maine personal exemption amount conforms to the 2013 federal personal

exemption amount. As such, the 2013 Maine personal exemption amount is $3,900.

These changes are reflected in the 2013 annualized percentage method for calculating Maine

withholding (see below). If you have any questions about the 2013 withholding calculation,

please call 207 626-8475 (press 1, option 4) or email withholding.tax@maine.gov.

2013 MAINE INCOME TAX WITHHOLDING - ANNUALIZED PERCENTAGE METHOD

Step 1 Convert total wages to annual wage amount. Multiply by the payroll frequency: 52 for weekly, 26 for biweekly, 24 for semimonthly,

12 for monthly, 260 for daily or miscellaneous payroll period.

Step 2 Multiply the number of withholding allowances the employee claims by $3,900. Subtract the result from the annualized wage

amount calculated in step 1 to compute the annualized income.

Step 3 Adjustment for Nonresident Aliens. If the employee is a nonresident alien, increase the annualized wages by $6,100. Do not make

this adjustment for employees who are residents of the United States.

Step 4 Compute the annualized withholding amount using the withholding rate schedules below based on the annualized income

computed in steps 1, 2 and 3.

Step 5 Divide the annualized withholding amount computed in step 4 by the payroll frequency used in step 1 and round to the nearest

dollar. The result is the amount of Maine income tax to be withheld from the payment being made.

For Single Taxpayers

If the annualized income is:

The annualized withholding is:

Less than

$ 8,450

0.0%

$ 8,450 but less than

$ 24,150

6.5% of excess over

$ 8,450

$ 24,150 or more

$ 1,021 plus 7.95% of excess over

$ 24,150

For Married Taxpayers

If the annualized income is:

The annualized withholding is:

Less than

$ 17,750

0.0%

$ 17,750 but less than

$ 49,150

6.50% of excess over

$ 17,750

$ 49,150 or more

$ 2,041 plus 7.95% of excess over

$ 49,150

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1