INSTRUCTIONS

Adoption Tax Credit: Individuals and business entities may claim a tax credit

Line 1: Enter the total amount of the reasonable and necessary adoption fees

for their total nonrecurring adoption expenses. Missouri residents may claim up

incurred.

to $10,000 per child. The full credit may be claimed when the adoption is final, or

Line 2: Enter the total amount of court costs associated in the adoption of the

a claim for 50 percent of the credit may be made when the child is placed in the

special needs child.

home and the remaining 50 percent may be claimed when the adoption is final.

Line 3: Enter the total amount of attorney fees associated in the adoption of

The credit is non-refundable and limited to the tax liability. The credit is

the special needs child.

available for a total of five consecutive years. The five year period begins when

Line 4: Enter the total amount of other directly related expenses (which are not

the credit is first taken or the adoption is final, whichever occurs first.

in violations of federal, state, or local laws.)

The cumulative amount of adoption tax credits claimed cannot exceed the limit

Line 5: Add Lines 1 through 4 and enter the amount on Line 5. This is the total

established in Section 135.327, RSMo.

amount of nonrecurring special needs adoption expenses. Employers claiming

Special Needs Child: A child for whom it has been determined by the Missouri

the credit enter total on Line 5 and then skip to Line 11.

Department of Social Services, Children’s Division, a child-placing agency

Line 6: Enter the amount paid by the Missouri Department of Social Services,

licensed by the state, or a court of com petent jurisdiction to be a child who has

Children’s Division.

a specific factor or condition such as ethnic background, age, membership in a

minority or sibling group, medical condition, or handicap because of which it is

Line 7: Enter the amount paid by your employer.

reasonable to conclude that such child cannot be easily placed with adoptive

Line 8: Enter the amount claimed as an adoption tax credit on your Federal

parents.

Income Tax Return.

To Claim the Adoption Tax Credit: Attach Form MO-ATC and Form MO-TC

Line 9: Enter the amount you received from other state or local programs.

to the tax return the first year the adoption tax credit is claimed. (The remaining

four years the credit is claimed only attach Form MO-TC to the return.)

Line 10: Add Lines 6 through 9 and enter the amount on Line 10.

When first claiming the credit as the result of a sale or assignment, attach a

Line 11: Subtract the amount on Line 10 from the amount on Line 5. Enter the

statement signed by the seller including the names, addresses, and social

amount on Line 11. (Employer enter amount from Line 5.) If Line 10 exceeds

security numbers of the buyer and seller, the date the credit was sold, the

the amount on Line 5, enter zero (0) on Line 11.

amount of the tax credit sold, and a copy of the original Form MO-ATC

Line 12: The special needs adoption tax credit is limited to the lesser of

completed by the adoptive parents, as well as Part A of the revised form.

the total on Line 11 or $10,000. Enter the smaller amount on Line 12.

Due Date: Beginning July 1, 2006, applications to claim the ATC for children

who were Missouri residents when the adoption was initiated must be filed

Part D

between July 1 and April 15 of each fiscal year. Also beginning July 1, 2006,

The Missouri Department of Social Services, Children’s Division must certify the

applications to claim the ATC for children who were not Missouri residents

adoption expenses in Part C will not be reimbursed from funds available under

when the adoption was initiated must be filed between July 1 and December 31

any federal, state, or local programs. If credit is claimed upon placement of the

of each fiscal year.

child, this certification will be completed at that time and does not need to be

resubmitted, when the adoption is final or when the remainder of the credit is

Line-by-Line Instructions

claimed.

Part A

Part E

Enter the adopted special needs child information and provide answers to the

Must be completed by the agency certifying the child meets the criteria as a

questions by checking each appropriate box.

special needs child. If the credit is claimed upon placement of the child, this

Part B

certification will be completed and submitted at that time and does not need to

be resubmitted when the adoption is final or when the remainder of the credit is

Enter the employer information if they have provided funds to ward the adoption

claimed.

and are claiming a portion of the credit.

If you require additional information, you may call the Missouri

Part C

Department of Revenue at (573) 526-8733 or (573) 751-5268 or e-mail:

Enter the nonrecurring adoption expenses incurred by the adoptive parents

taxcredit@dor.mo.gov.

or the employer (up to $10,000). Nonrecurring adoption expenses include:

reasonable and necessary adoption fees, court costs, attorney fees, and other

expenses which are directly related to the adoption of a special needs child and

are not incurred in violation of federal, state, or local laws. Section 135.815,

RSMo, requires the Department to reduce the credit by any in come, sales, use,

or insurance tax delinquency including interest and penalties.

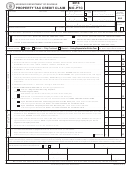

ADOPTION TAX CREDIT WORKSHEET

Use the Adoption Tax Credit Worksheet to track your available credit.

1st Year

2nd Year

3rd Year

4th Year

5th Year

A. Tax liability ......................................................................

B. Amount claimed ..............................................................

Amount from Form

Ending Balance

Ending Balance

Ending Balance

Ending Balance

(1st Year Line F)

(2nd Year Line F)

(3rd Year Line F)

MO-ATC, Part C,

(4th Year Line F)

Line 12

C. Beginning balance ..........................................................

D. Amount allowed by DOR ................................................

E. Credit sold or transferred ................................................

F. Ending balance (Line C less Line D, and Line E) ............

MO-ATC (12-2012)

1

1 2

2