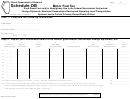

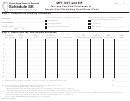

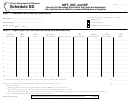

Schedule Sb (Form Rmft-7-Sf) - Motor Fuel Tax Page 2

ADVERTISEMENT

General Instructions

What must I attach to this schedule to

Which special fuels must be reported

Column 2 - Write the invoice number of the sale

claim an exemption?

on Schedule SB?

or the serial number, if any, of the certificate of

exemption.

The special fuels that must be reported on this

You must attach a certificate of exemption to

schedule include diesel and any other petroleum

Schedule SB for all sales except sales to the

Column 3 - Write the carrier’s complete business

products ( e.g., furnace oil, heating oil, range oil,

federal government, an authorized foreign diplo-

name.

and kerosene) intended for use or offered for sale

mat or non-recreational type watercraft. We will not

as a fuel for engines in which the fuel is injected

allow your exemption without this certificate. Also,

Column 4 - Write the bill of lading or manifest

into the combustion chamber and ignited by

we will not allow your exemption if we do not recog-

number.

pressure without electric spark. This does not

nize the purchaser as a federal agency, authorized

include 1-K kerosene or dyed diesel fuel. Report

foreign diplomat or non-recreational type water-

Column 5 - Write the exact name of the federal

your dyed diesel fuel transactions on Schedule

craft.

government agency, the authorized foreign diplo-

DB, Form RMFT-7-DF.

mat, the qualifying municipal corporation, the

What records must I keep?

qualifying privately owned public utility to whom

What sales must I report on this

You are required by law to keep books and

the sale was made, or the non-recreational type

schedule?

records showing all purchases, receipts, losses

watercraft.

through any cause, sales, distributions, and use of

Report on this schedule special fuels that you

fuels.

sold to:

Column 6 - Write the name of the Illinois city from

•

the federal government

which the special fuel originated.

What if I need additional assistance?

•

authorized foreign diplomats

If you have questions about this schedule, write to

Column 7 - Write the name of the Illinois city to

•

municipal corporations owning and operating

us at Motor Fuel Tax, Illinois Department of

which the special fuel was delivered.

local transportation systems

Revenue, P .O. Box 19477, Springfield, Illinois

•

62794-9477, or call our Springfield office week-

privately owned public utilities that own and

Column 8 - Write the number of invoiced gallons.

days between 8:00 a.m. and 4:30 p.m. at

operate two-axle vehicles designed and used for

217 782-2291.

transporting more than seven passengers. The

Line 11 - Add the invoiced gallons reported in

vehicles must be used as common carriers in

Column 8, Lines 1 through 10.

the general transportation of passengers, not be

Step-by-Step Instructions

devoted to any specialized purpose, and be

Line 12 - If you are filing only one Schedule SB,

operated entirely within the territorial limits of a

write the amount from Line 11 on Line 12 and on

single municipality or of any group of contiguous

Form RMFT-5, Line 6, Column 2. If you are filing

Step 1: Complete the following

municipalities or in a close radius thereof. In

more than one Schedule SB, add Line 11 from

information

addition, the utilities’ operations must be subject

each schedule and write the total on Line 12 of the

Write your company name, your license number,

to the Illinois Commerce Commission

last page. Also write this amount on Form RMFT-5,

and the period for which you are reporting.

regulations.

Line 6, Column 2.

•

non-recreational type watercraft

Step 2: Report your nontaxable sales

When do I file this schedule?

Lines 1 through 10 —

You must file Schedule SB with Form RMFT-5,

Column 1 - Write the month, day, and year of the

Motor Fuel Distributor/Supplier Tax Return.

invoice.

RMFT-7-SF back (R-6/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2