Instructions For Form Das-29 - Resident Stamp Affixing Agency Monthly Report Of Cigarettes And Cigarette Tax Stamps

ADVERTISEMENT

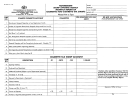

DAS-29 (12-12)

RESIDENT STAMP AFFIXING AGENCY

MONTHLY REPORT OF CIGARETTES AND

CIGARETTE TAX STAMPS REV-1030

BUREAU OF BUSINESS TRUST FUND TAXES

PO BOX 280909

INSTRUCTIONS

HARRISBURG, PA 17128-0909

REV-1030 and applicable schedules will show accountability of all cigarettes and/or stampable little cigars* and cigarette tax stamps for the

reporting period. Schedules A-1, B, C, D and F must accompany the report when applicable.

Due Date: Reports and appropriate schedules are due on or before the 20th day following the month in which the report is being made.

The cigarette stamping agency’s (CSA) name, CSA number and business address must be entered in the appropriate space provided on the

front of the report and on each schedule and/or supporting statement.

The report must be examined and signed by the owner, partner or officer.

*Stampable little cigars are defined as little cigars packaged similar to a pack of cigarettes, containing 20 to 25 sticks per pack.

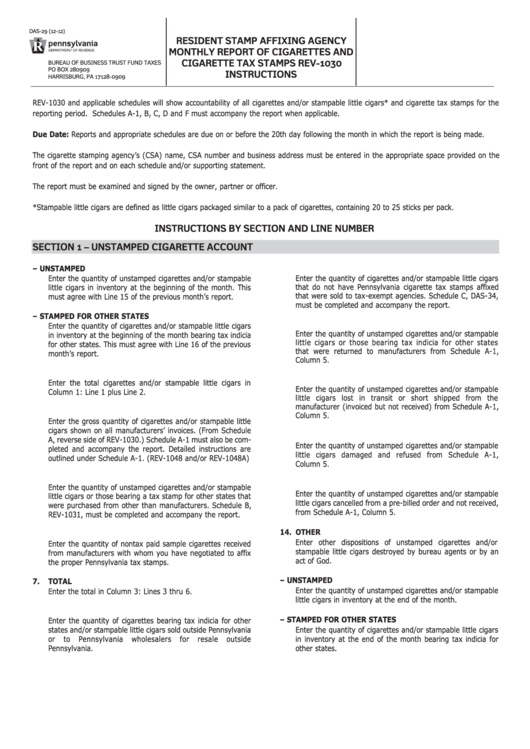

INSTRUCTIONS BY SECTION AND LINE NUMBER

SECTION 1 – UNSTAMPED CIGARETTE ACCOUNT

1.

OPENING INVENTORY – UNSTAMPED

9.

SOLD TO TAX - EXEMPT AGENCIES

Enter the quantity of cigarettes and/or stampable little cigars

Enter the quantity of unstamped cigarettes and/or stampable

that do not have Pennsylvania cigarette tax stamps affixed

little cigars in inventory at the beginning of the month. This

that were sold to tax-exempt agencies. Schedule C, DAS-34,

must agree with Line 15 of the previous month’s report.

must be completed and accompany the report.

2.

OPENING INVENTORY – STAMPED FOR OTHER STATES

10. RETURNED TO MANUFACTURER

Enter the quantity of cigarettes and/or stampable little cigars

Enter the quantity of unstamped cigarettes and/or stampable

in inventory at the beginning of the month bearing tax indicia

little cigars or those bearing tax indicia for other states

for other states. This must agree with Line 16 of the previous

that were returned to manufacturers from Schedule A-1,

month’s report.

Column 5.

3.

TOTAL INVENTORY

11. LOST IN TRANSIT/SHORTAGES

Enter the total cigarettes and/or stampable little cigars in

Enter the quantity of unstamped cigarettes and/or stampable

Column 1: Line 1 plus Line 2.

little cigars lost in transit or short shipped from the

manufacturer (invoiced but not received) from Schedule A-1,

4.

PURCHASES FROM MANUFACTURER

Column 5.

Enter the gross quantity of cigarettes and/or stampable little

cigars shown on all manufacturers’ invoices. (From Schedule

12. DAMAGED AND REFUSED

A, reverse side of REV-1030.) Schedule A-1 must also be com-

Enter the quantity of unstamped cigarettes and/or stampable

pleted and accompany the report. Detailed instructions are

little cigars damaged and refused from Schedule A-1,

outlined under Schedule A-1. (REV-1048 and/or REV-1048A)

Column 5.

5.

PURCHASES FROM OTHERS

13. CANCELLED FROM ORDERS

Enter the quantity of unstamped cigarettes and/or stampable

Enter the quantity of unstamped cigarettes and/or stampable

little cigars or those bearing a tax stamp for other states that

little cigars cancelled from a pre-billed order and not received,

were purchased from other than manufacturers. Schedule B,

from Schedule A-1, Column 5.

REV-1031, must be completed and accompany the report.

14. OTHER

6.

SAMPLE CIGARETTES

Enter other dispositions of unstamped cigarettes and/or

Enter the quantity of nontax paid sample cigarettes received

stampable little cigars destroyed by bureau agents or by an

from manufacturers with whom you have negotiated to affix

act of God.

the proper Pennsylvania tax stamps.

15. CLOSING INVENTORY – UNSTAMPED

7.

TOTAL

Enter the quantity of unstamped cigarettes and/or stampable

Enter the total in Column 3: Lines 3 thru 6.

little cigars in inventory at the end of the month.

8.

SOLD OUTSIDE PENNSYLVANIA

16. CLOSING INVENTORY – STAMPED FOR OTHER STATES

Enter the quantity of cigarettes bearing tax indicia for other

Enter the quantity of cigarettes and/or stampable little cigars

states and/or stampable little cigars sold outside Pennsylvania

or

to

Pennsylvania

wholesalers

for

resale

outside

in inventory at the end of the month bearing tax indicia for

Pennsylvania.

other states.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4