Reset Form

CAT QDC

Rev. 6/13

tax.ohio.gov

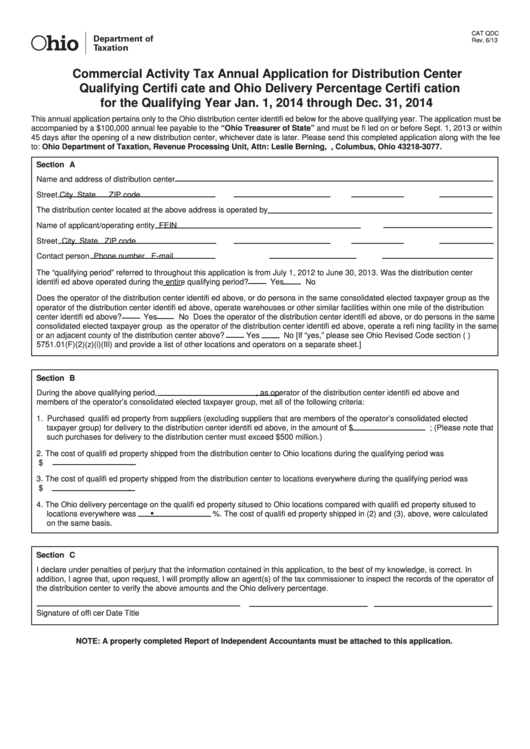

Commercial Activity Tax Annual Application for Distribution Center

Qualifying Certifi cate and Ohio Delivery Percentage Certifi cation

for the Qualifying Year Jan. 1, 2014 through Dec. 31, 2014

This annual application pertains only to the Ohio distribution center identifi ed below for the above qualifying year. The application must be

accompanied by a $100,000 annual fee payable to the “Ohio Treasurer of State” and must be fi led on or before Sept. 1, 2013 or within

45 days after the opening of a new distribution center, whichever date is later. Please send this completed application along with the fee

to: Ohio Department of Taxation, Revenue Processing Unit, Attn: Leslie Berning, P.O. Box 183077, Columbus, Ohio 43218-3077.

Section A

Name and address of distribution center

Street

City

State

ZIP code

The distribution center located at the above address is operated by

Name of applicant/operating entity

FEIN

Street

City

State

ZIP code

Contact person

Phone number

E-mail

The “qualifying period” referred to throughout this application is from July 1, 2012 to June 30, 2013. Was the distribution center

identifi ed above operated during the entire qualifying period?

Yes

No

Does the operator of the distribution center identifi ed above, or do persons in the same consolidated elected taxpayer group as the

operator of the distribution center identifi ed above, operate warehouses or other similar facilities within one mile of the distribution

center identifi ed above?

Yes

No Does the operator of the distribution center identifi ed above, or do persons in the same

consolidated elected taxpayer group as the operator of the distribution center identifi ed above, operate a refi ning facility in the same

or an adjacent county of the distribution center above?

Yes

No [If “yes,” please see Ohio Revised Code section (R.C.)

5751.01(F)(2)(z)(i)(III) and provide a list of other locations and operators on a separate sheet.]

Section B

During the above qualifying period,

, as operator of the distribution center identifi ed above and

members of the operator’s consolidated elected taxpayer group, met all of the following criteria:

1. Purchased qualifi ed property from suppliers (excluding suppliers that are members of the operator’s consolidated elected

taxpayer group) for delivery to the distribution center identifi ed above, in the amount of $

; (Please note that

such purchases for delivery to the distribution center must exceed $500 million.)

2. The cost of qualifi ed property shipped from the distribution center to Ohio locations during the qualifying period was

$

.

3. The cost of qualifi ed property shipped from the distribution center to locations everywhere during the qualifying period was

$

.

4. The Ohio delivery percentage on the qualifi ed property sitused to Ohio locations compared with qualifi ed property sitused to

.

locations everywhere was

%. The cost of qualifi ed property shipped in (2) and (3), above, were calculated

on the same basis.

Section C

I declare under penalties of perjury that the information contained in this application, to the best of my knowledge, is correct. In

addition, I agree that, upon request, I will promptly allow an agent(s) of the tax commissioner to inspect the records of the operator of

the distribution center to verify the above amounts and the Ohio delivery percentage.

Signature of offi cer

Date

Title

NOTE: A properly completed Report of Independent Accountants must be attached to this application.

1

1 2

2 3

3 4

4