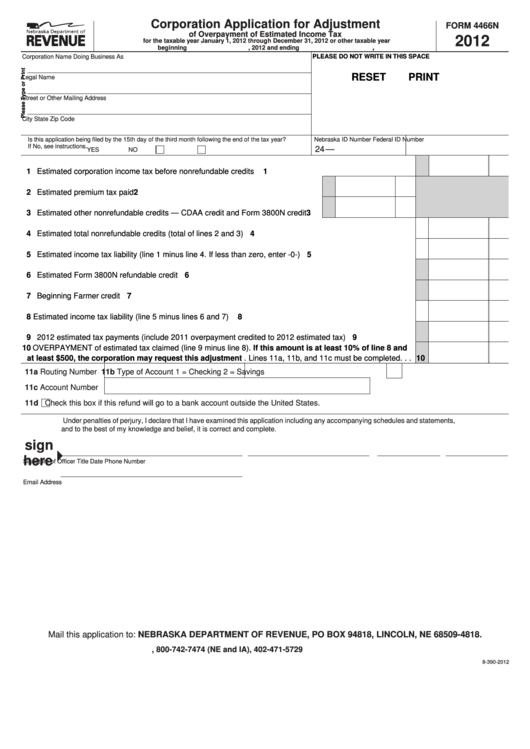

Corporation Application for Adjustment

FORM 4466N

of Overpayment of Estimated Income Tax

2012

for the taxable year January 1, 2012 through December 31, 2012 or other taxable year

,

beginning

, 2012 and ending

Corporation Name Doing Business As

PLEASE DO NOT WRITE IN THIS SPACE

RESET

PRINT

Legal Name

Street or Other Mailing Address

City

State

Zip Code

Is this application being filed by the 15th day of the third month following the end of the tax year?

Nebraska ID Number

Federal ID Number

If No, see instructions.

24 —

YES

NO

1 Estimated corporation income tax before nonrefundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Estimated premium tax paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Estimated other nonrefundable credits — CDAA credit and Form 3800N credit . . . . .

3

4 Estimated total nonrefundable credits (total of lines 2 and 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Estimated income tax liability (line 1 minus line 4. If less than zero, enter -0-). . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Estimated Form 3800N refundable credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Beginning Farmer credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Estimated income tax liability (line 5 minus lines 6 and 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 2012 estimated tax payments (include 2011 overpayment credited to 2012 estimated tax) . . . . . . . . . . . . . . . . . 9

10 OVERPAYMENT of estimated tax claimed (line 9 minus line 8). If this amount is at least 10% of line 8 and

at least $500, the corporation may request this adjustment . Lines 11a, 11b, and 11c must be completed. . . 10

11a Routing Number

11b Type of Account

1 = Checking

2 = Savings

11c Account Number

11d

Check this box if this refund will go to a bank account outside the United States.

Under penalties of perjury, I declare that I have examined this application including any accompanying schedules and statements,

and to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Officer

Title

Date

Phone Number

Email Address

Mail this application to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94818, LINCOLN, NE 68509-4818.

, 800-742-7474 (NE and IA), 402-471-5729

8-390-2012

1

1 2

2