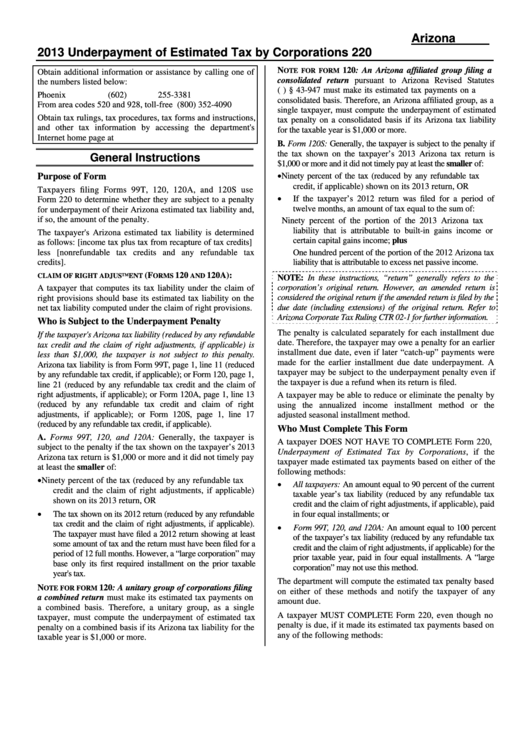

Instructions For Form 220 - Underpayment Of Estimated Tax By Corporations - 2013

ADVERTISEMENT

Arizona Form

2013 Underpayment of Estimated Tax by Corporations

220

N

120: An Arizona affiliated group filing a

OTE FOR FORM

Obtain additional information or assistance by calling one of

consolidated return pursuant to Arizona Revised Statutes

the numbers listed below:

(A.R.S.) § 43-947 must make its estimated tax payments on a

Phoenix

(602) 255-3381

consolidated basis. Therefore, an Arizona affiliated group, as a

From area codes 520 and 928, toll-free

(800) 352-4090

single taxpayer, must compute the underpayment of estimated

Obtain tax rulings, tax procedures, tax forms and instructions,

tax penalty on a consolidated basis if its Arizona tax liability

and other tax information by accessing the department's

for the taxable year is $1,000 or more.

Internet home page at

B. Form 120S: Generally, the taxpayer is subject to the penalty if

the tax shown on the taxpayer’s 2013 Arizona tax return is

General Instructions

$1,000 or more and it did not timely pay at least the smaller of:

Purpose of Form

Ninety percent of the tax (reduced by any refundable tax

credit, if applicable) shown on its 2013 return, OR

Taxpayers filing Forms 99T, 120, 120A, and 120S use

If the taxpayer’s 2012 return was filed for a period of

Form 220 to determine whether they are subject to a penalty

twelve months, an amount of tax equal to the sum of:

for underpayment of their Arizona estimated tax liability and,

if so, the amount of the penalty.

Ninety percent of the portion of the 2013 Arizona tax

liability that is attributable to built-in gains income or

The taxpayer's Arizona estimated tax liability is determined

certain capital gains income; plus

as follows: [income tax plus tax from recapture of tax credits]

less [nonrefundable tax credits and any refundable tax

One hundred percent of the portion of the 2012 Arizona tax

credits].

liability that is attributable to excess net passive income.

(F

120

120A):

CLAIM OF RIGHT ADJUSTMENT

ORMS

AND

NOTE: In these instructions, “return” generally refers to the

corporation’s original return. However, an amended return is

A taxpayer that computes its tax liability under the claim of

considered the original return if the amended return is filed by the

right provisions should base its estimated tax liability on the

due date (including extensions) of the original return. Refer to

net tax liability computed under the claim of right provisions.

Arizona Corporate Tax Ruling CTR 02-1 for further information.

Who is Subject to the Underpayment Penalty

The penalty is calculated separately for each installment due

If the taxpayer's Arizona tax liability (reduced by any refundable

date. Therefore, the taxpayer may owe a penalty for an earlier

tax credit and the claim of right adjustments, if applicable) is

installment due date, even if later “catch-up” payments were

less than $1,000, the taxpayer is not subject to this penalty.

made for the earlier installment due date underpayment. A

Arizona tax liability is from Form 99T, page 1, line 11 (reduced

taxpayer may be subject to the underpayment penalty even if

by any refundable tax credit, if applicable); or Form 120, page 1,

the taxpayer is due a refund when its return is filed.

line 21 (reduced by any refundable tax credit and the claim of

right adjustments, if applicable); or Form 120A, page 1, line 13

A taxpayer may be able to reduce or eliminate the penalty by

(reduced by any refundable tax credit and claim of right

using the annualized income installment method or the

adjustments, if applicable); or Form 120S, page 1, line 17

adjusted seasonal installment method.

(reduced by any refundable tax credit, if applicable).

Who Must Complete This Form

A. Forms 99T, 120, and 120A: Generally, the taxpayer is

A taxpayer DOES NOT HAVE TO COMPLETE Form 220,

subject to the penalty if the tax shown on the taxpayer’s 2013

Underpayment of Estimated Tax by Corporations, if the

Arizona tax return is $1,000 or more and it did not timely pay

taxpayer made estimated tax payments based on either of the

at least the smaller of:

following methods:

Ninety percent of the tax (reduced by any refundable tax

All taxpayers: An amount equal to 90 percent of the current

credit and the claim of right adjustments, if applicable)

taxable year’s tax liability (reduced by any refundable tax

shown on its 2013 return, OR

credit and the claim of right adjustments, if applicable), paid

The tax shown on its 2012 return (reduced by any refundable

in four equal installments; or

tax credit and the claim of right adjustments, if applicable).

Form 99T, 120, and 120A: An amount equal to 100 percent

The taxpayer must have filed a 2012 return showing at least

of the taxpayer’s tax liability (reduced by any refundable tax

some amount of tax and the return must have been filed for a

credit and the claim of right adjustments, if applicable) for the

period of 12 full months. However, a “large corporation” may

prior taxable year, paid in four equal installments. A “large

base only its first required installment on the prior taxable

corporation” may not use this method.

year's tax.

The department will compute the estimated tax penalty based

N

120: A unitary group of corporations filing

OTE FOR FORM

on either of these methods and notify the taxpayer of any

a combined return must make its estimated tax payments on

amount due.

a combined basis. Therefore, a unitary group, as a single

A taxpayer MUST COMPLETE Form 220, even though no

taxpayer, must compute the underpayment of estimated tax

penalty is due, if it made its estimated tax payments based on

penalty on a combined basis if its Arizona tax liability for the

any of the following methods:

taxable year is $1,000 or more.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5