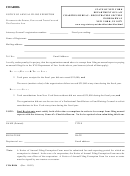

Instructions for Form 4075,

Notice of Denial of Principal Residence Exemption

(County)

General Instructions

This form is for county Treasurers or Equalization Directors

Line 12: Check the box indicating the reason the principal

to use when notifying a homeowner that his or her principal

residence exemption was denied. If none apply, check

"other" and enter a more detailed explanation of your reasons

residence exemption is denied. It will also be used to notify the

for denial. Be specific and as complete as possible. The

Department of Treasury of the denial. Complete all information

information you provide in this section may be used in the

carefully and accurately to avoid processing errors.

appeals process.

Mail a copy to Treasury with a copy of Form 2753, Batch

Line 13: Enter all years that are being denied. (You have

Cover for Principal Residence Exemption. Label them as

the authority to deny the current year and the three

denials.

preceding years.)

Mail the original to the homeowner. Their appeal rights are

Line 14: Enter the percentage of which the principal residence

printed on the bottom of the form. Make a copy for your

exemption has been adjusted to.

.

records

Line-by-Line Instructions

Line 15: Signature. This form must be signed by either the

county Treasurer or Equalization Director. Indicate who is

IMPORTANT: Complete a separate form for each

denying exemption.

property being denied.

Line 16: Date. The homeowner has only 35 days to appeal

Line 1: You must complete this line. Do not enter more

an exemption denial. The date you enter here is the starting

than one property identification (PIN) on each form. The

date for the homeowner's appeal time. Mail all forms the

PIN should be identical to the number used on the original

day they are signed.

affidavit.

Line 17: Enter the address and telephone number of the

Lines 2-6: Enter the complete address of the property you are

proper contact person at the local government.

claiming. Enter name and check the appropriate box for the

city or township in which the principal residence is located.

Additional Forms or Questions?

Insert the local revenue share code (6 digits) for the unit in

This form is available on our Treasury Web site at:

which the property is located in box 4.

Lines 7-10: Enter the name and social security number(s) of

the legal owner(s) that occupy the property.

If you have questions call 517-373-1950.

Line 11: Enter the mailing address if it is different from the

address on line 2.

1

1 2

2