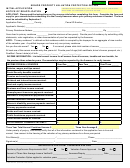

INSTRUCTIONS

SENIOR PROPERTY VALUATION PROTECTION OPTION

Arizona voters approved Proposition 104 in the November, 2000 General Election,

and Proposition 102 in the November, 2002 General Election, thereby amending

the Arizona Constitution. The Amendments provide for the “freezing” of the

valuation of the primary residence of those seniors who meet all of the following

requirements:

1.

At least one of the owners must be sixty-five years of age at the time the

application is fi led. A copy of proof of age must be submitted.

2.

The property must be the primary residence of the taxpayer. For purposes

of this application “Primary Residence” is defi ned as the residence which is

occupied by the taxpayer for an aggregate of nine months of the calendar

year.

3.

The owner must have resided in the primary residence for at least two years

prior to applying for the option.

4.

The owner(s) total income from all sources, including non taxable income,

cannot exceed the amount specifi ed by law.

For an initial valuation protection option application, if the owner meets all of these

requirements and the County Assessor approves the application, the valuation of

the primary residence will remain fi xed for a three year period.

To remain eligible, the owner is required to renew the valuation protection option

during the last six months of the three year period on receipt of a notice of

reapplication from the County Assessor.

The freeze terminates if the owner sells the home or otherwise becomes ineligible.

The property’s valuation will revert to its current full cash value as determined by

the County Assessor in the valuation year in which the sale is completed.

Please be aware that, while the VALUATION will be frozen for as long as the

owner remains eligible, TAXES for the primary residence will NOT be frozen and

will continue to be levied at the same rate that is applicable to all other properties

in the taxing district.

1

1 2

2