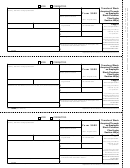

Form 3922 - Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C) Page 6

ADVERTISEMENT

Instructions for Corporation

File Copy A of this form with the IRS by February 28

To complete Form 3922, use:

of the year following the year of first transfer of the

• the current General Instructions for Certain

stock acquired through the employee stock purchase

Information Returns, and

plan. If you file electronically, the due date is March 31

of the year following the year of first transfer of the

• the current Instructions for Forms 3921 and 3922.

stock acquired through the employee stock purchase

To order these instructions and additional forms, go

plan. To file electronically, you must have software that

to or call 1-800-TAX-FORM

generates a file according to the specifications in Pub.

(1-800-829-3676).

1220, Specifications for Electronic Filing of Forms 1097,

Caution. Because paper forms are scanned during

1098, 1099, 3921, 3922, 5498, 8935, and W-2G. The

processing, you cannot file Forms 1096, 1097, 1098,

IRS does not provide a fill-in form option.

1099, 3921, 3922, or 5498 that you print from the IRS

Need help? If you have questions about reporting on

website.

Form 3922, call the information reporting customer

Due dates. Furnish Copy B of this form to the employee

service site toll free at 1-866-455-7438 or 304-263-8700

by January 31 of the year following the year of first

(not toll free). Persons with a hearing or speech

transfer of the stock acquired through the employee

disability with access to TTY/TDD equipment can call

stock purchase plan.

304-579-4827 (not toll free).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6