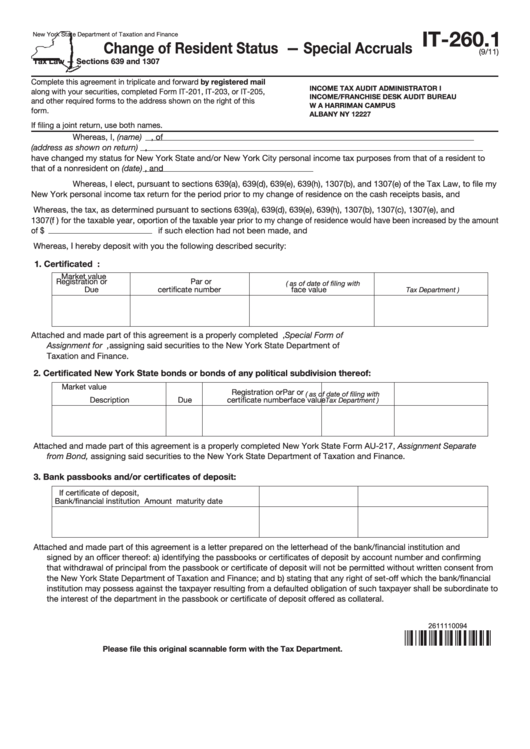

IT-260.1

New York State Department of Taxation and Finance

Change of Resident Status — Special Accruals

(9/11)

Tax Law — Sections 639 and 1307

Complete this agreement in triplicate and forward by registered mail

INCOME TAX AUDIT ADMINISTRATOR I

along with your securities, completed Form IT-201, IT-203, or IT-205,

INCOME/FRANCHISE DESK AUDIT BUREAU

and other required forms to the address shown on the right of this

W A HARRIMAN CAMPUS

form.

ALBANY NY 12227

If filing a joint return, use both names.

Whereas, I, (name)

, of

(address as shown on return)

,

have changed my status for New York State and/or New York City personal income tax purposes from that of a resident to

that of a nonresident on (date)

, and

Whereas, I elect, pursuant to sections 639(a), 639(d), 639(e), 639(h), 1307(b), and 1307(e) of the Tax Law, to file my

New York personal income tax return for the period prior to my change of residence on the cash receipts basis, and

Whereas, the tax, as determined pursuant to sections 639(a), 639(d), 639(e), 639(h), 1307(b), 1307(c), 1307(e), and

1307(f ) for the taxable year, or portion of the taxable year prior to my change of residence would have been increased by the amount

of $

if such election had not been made, and

I hereby deposit with you the following described security:

Whereas,

1.

Certificated U.S. Treasury bonds:

Market value

Registration or

Par or

( as of date of filing with

Due

certificate number

face value

Tax Department )

Attached and made part of this agreement is a properly completed U.S. Treasury Form PDF 1832, Special Form of

Assignment for U.S. Registered Definitive Securities, assigning said securities to the New York State Department of

Taxation and Finance.

2.

Certificated New York State bonds or bonds of any political subdivision thereof:

Market value

Registration or

Par or

( as of date of filing with

Description

Due

certificate number

face value

Tax Department )

Attached and made part of this agreement is a properly completed New York State Form AU-217, Assignment Separate

from Bond, assigning said securities to the New York State Department of Taxation and Finance.

3.

Bank passbooks and/or certificates of deposit:

If certificate of deposit,

Bank/financial institution

Amount

maturity date

Attached and made part of this agreement is a letter prepared on the letterhead of the bank/financial institution and

signed by an officer thereof: a) identifying the passbooks or certificates of deposit by account number and confirming

that withdrawal of principal from the passbook or certificate of deposit will not be permitted without written consent from

the New York State Department of Taxation and Finance; and b) stating that any right of set-off which the bank/financial

institution may possess against the taxpayer resulting from a defaulted obligation of such taxpayer shall be subordinate to

the interest of the department in the passbook or certificate of deposit offered as collateral.

2611110094

Please file this original scannable form with the Tax Department.

1

1 2

2