Certificate of Compliance by Non-Participating

Manufacturer Regarding Escrow Payment

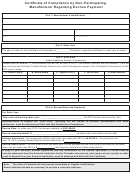

Part 1: Manufacturer’s Identification

Name

Address

Phone

Fax

Web Site Address

Email

Part 2: Sales Year

The year of sales for the Certificate of Compliance is:__________(Complete a separate certificate for each year of sales.)

Part 3: Units Sold

(Attach Additional Sheets, if necessary)

Indicate with an asterisk (*) those brands that will not be sold in 2013. The brands indicated with an asterisk (*) will be

removed from the Colorado Certified Brands Directory the month following the receipt of the Certificate of Compliance for the

2012 year of sales.

A. Brand Family

B. Brand Name

C. Cigarette or RYO

C. Units Sold

D. Manufacturer

*

Part 4: Escrow Rates and Payments

For Sales Year:

Total units sold during sales year: _________________________________ (for RYO divide ounces sold by .09)

Documentation to support the “units sold,” including but not limited to invoices, spreadsheets and sales

statements, must be attached and filed with this Certificate of Compliance.

Escrow Rate: for sales year 2012, the rate per cigarette is $0.0188482.

Escrow deposit subtotal: $ __________________________________ (multiply total units sold by escrow rate)

Inflation adjustment: The appropriate inflation adjustment for sales year 2012 is 54.42219%. For payments due

April 15, 2013, multiply Escrow Deposit entered above by. $

.

Escrow deposit paid: The total amount that has been paid into the qualified escrow fund by the manufacturer identified

above for the sales year 2012 is $

(add deposit subtotal and inflation adjustment)

A copy of your executed Escrow Agreement and any amendment to the Escrow Agreement, a current escrow

account statement from the financial institution for the Colorado sub-account, and copies of your receipt or other

proof of deposit from your financial institution, must be attached and filed with this Certificate.

Note:

The state of Colorado will not process incomplete or illegible certifications.

Attach additional sheets as necessary to provide a complete response.

1

1 2

2 3

3