Reset Form

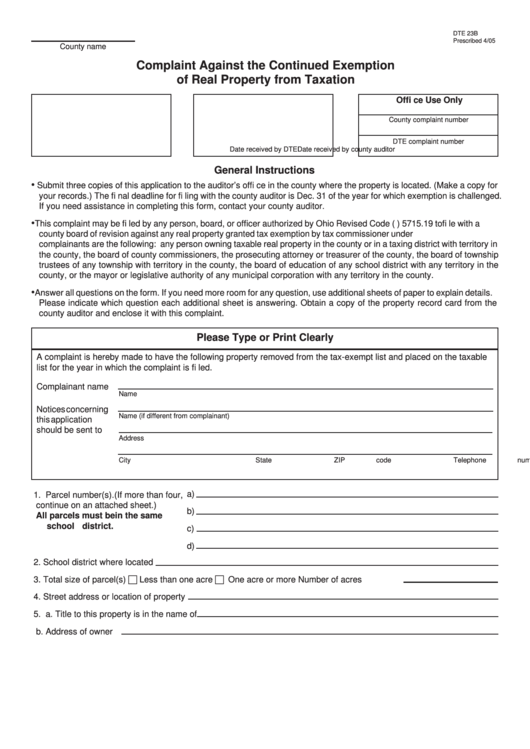

DTE 23B

Prescribed 4/05

County name

Complaint Against the Continued Exemption

of Real Property from Taxation

Offi ce Use Only

County complaint number

DTE complaint number

Date received by county auditor

Date received by DTE

General Instructions

•

Submit three copies of this application to the auditor’s offi ce in the county where the property is located. (Make a copy for

your records.) The fi nal deadline for fi ling with the county auditor is Dec. 31 of the year for which exemption is challenged.

If you need assistance in completing this form, contact your county auditor.

•

This complaint may be fi led by any person, board, or offi cer authorized by Ohio Revised Code (R.C.) 5715.19 to fi le with a

county board of revision against any real property granted tax exemption by tax commissioner under R.C. 5715.27. Eligible

complainants are the following: any person owning taxable real property in the county or in a taxing district with territory in

the county, the board of county commissioners, the prosecuting attorney or treasurer of the county, the board of township

trustees of any township with territory in the county, the board of education of any school district with any territory in the

county, or the mayor or legislative authority of any municipal corporation with any territory in the county.

•

Answer all questions on the form. If you need more room for any question, use additional sheets of paper to explain details.

Please indicate which question each additional sheet is answering. Obtain a copy of the property record card from the

county auditor and enclose it with this complaint.

Please Type or Print Clearly

A complaint is hereby made to have the following property removed from the tax-exempt list and placed on the taxable

list for the year in which the complaint is fi led.

Complainant name

Name

Notices concerning

Name (if different from complainant)

this application

should be sent to

Address

City

State

ZIP code

Telephone number

a)

1. Parcel number(s).(If more than four,

continue on an attached sheet.)

b)

All parcels must be in the same

school district.

c)

d)

2. School district where located

Less than one acre

One acre or more

3. Total size of parcel(s)

Number of acres

4. Street address or location of property

5. a. Title to this property is in the name of

b. Address of owner

1

1 2

2