JT-1/UC-001 (7/11)

Page 2

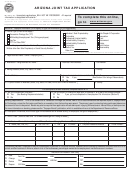

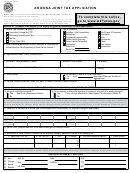

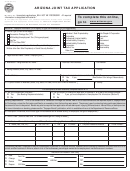

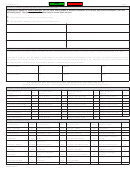

Section B: Transaction Privilege Tax (TPT)

1. Date Business Started in Arizona

2. Date Sales Began

3. What is your anticipated annual income for your fi rst twelve months of business?

*

*

4. Business Classes (Select at least one. See Section H for a listing of business classes on page 4)

*

5. TPT Filing Method

6. Does your business sell tobacco products?

7. Does your business sell new motor vehicle tires or

vehicles?

Yes

If yes,

Retailer

Cash Receipts

No

OR

Accrual

No

Distributor

Yes

(You will be required to fi le a TR-1.)

If yes, please check the months in which you intend to do business:

8. Are you a seasonal fi ler?

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Yes

No

9. Location of Tax Records (Street Address, City, State and ZIP code) Do not use PO Box or Route No.

*

10. Name of Company or Person to Contact

11. Phone Number

For additional locations, complete the following: (If more space is needed, please attach additional sheets)

12. “Doing Business As” Name for this Location

13. Phone Number

14. Physical Location Address (Do not use PO Box or Route No.)

15. City

16. County

17. State

18. ZIP code

19. “Doing Business As” Name for this Location

20. Phone Number

21. Physical Location Address (Do not use PO Box or Route No.)

22. City

23. County

24. State

25. ZIP code

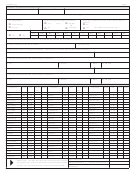

Section C: Program Cities / License Fees Below is a list of cities and towns licensed by the Arizona Department of Revenue.

City/Town

Code

Fee

No. of

Total

City/Town

Code

Fee

No. of

Total

City/Town

Code

Fee

No. of

Total

Loc

Loc

Loc

Benson

BS

5.00

Hayden

HY

5.00

Show Low

SL

2.00

Bisbee

BB

1.00

Holbrook

HB

1.00

Sierra Vista

SR

1.00

Buckeye

BE

2.00

Huachuca City

HC

2.00

Snowfl ake

SN

2.00

Jerome

JO

2.00

South Tucson

ST

2.00

Camp Verde

CE

2.00

Kearny

KN

2.00

Springerville

SV

5.00

Carefree

CA

10.00

Kingman

KM

2.00

St. Johns

SJ

2.00

Casa Grande

CG

2.00

Lake Havasu

LH

5.00

Star Valley

SY

2.00

Cave Creek

CK

20.00

Litchfi eld Park

LP

2.00

Superior

SI

2.00

Chino Valley

CV

2.00

Mammoth

MH

2.00

Surprise

SP

10.00

Clarkdale

CD

2.00

Clifton

CF

2.00

Marana

MA

5.00

Taylor

TL

2.00

Colorado City

CC

2.00

Maricopa

MP

2.00

Thatcher

TC

2.00

Coolidge

CL

2.00

Miami

MM

2.00

Tolleson

TN

2.00

Cottonwood

CW

2.00

Oro Valley

OR

12.00

Tombstone

TS

1.00

Dewey/Humboldt

DH

2.00

Page

PG

2.00

Tusayan

TY

2.00

Duncan

DC

2.00

Paradise Valley

PV

2.00

Wellton

WT

2.00

Eagar

EG

10.00

Parker

PK

2.00

Wickenburg

WB

2.00

El Mirage

EM

15.00

Patagonia

PA

25.00

Williams

WL

2.00

Eloy

EL

10.00

Payson

PS

2.00

Winkelman

WM

2.00

Florence

FL

2.00

Pima

PM

2.00

Winslow

WS

10.00

Fountain Hills

FH

2.00

Pinetop/Lakeside

PP

2.00

Youngtown

YT

10.00

Fredonia

FD

10.00

Prescott Valley

PL

2.00

Yuma

YM

2.00

Gila Bend

GI

2.00

Quartzsite

QZ

2.00

Gilbert

GB

2.00

Queen Creek

QC

2.00

Globe

GL

2.00

Safford

SF

2.00

Goodyear

GY

5.00

Sahuarita

SA

5.00

Guadalupe

GU

2.00

San Luis

SU

2.00

4

Total of City Fees:

Please Note: City fees are subject to change (go to our website

for updates). For cities not listed above, please contact the cities

State Fees $12.00 X _____ Number of Locations:

directly. Your license will not be issued until all fees are paid.

TOTAL Fees:

ADOR 10194 (7/11)

1

1 2

2 3

3 4

4 5

5 6

6