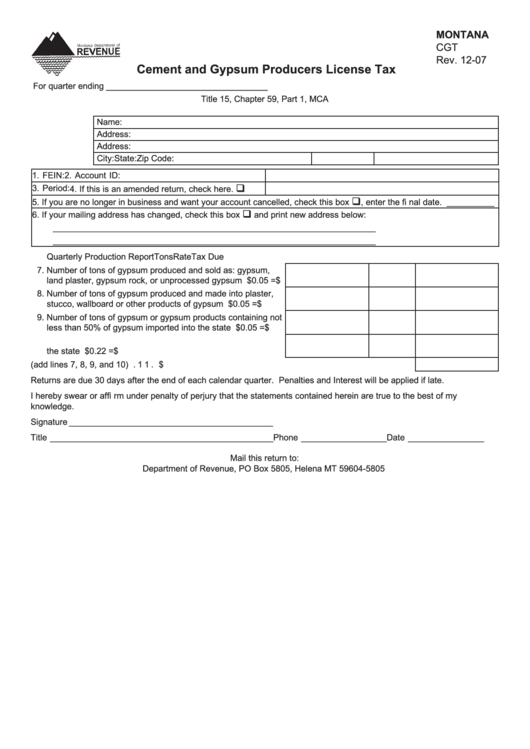

MONTANA

CGT

Rev. 12-07

Cement and Gypsum Producers License Tax

For quarter ending __________________________________

Title 15, Chapter 59, Part 1, MCA

Name:

Address:

Address:

City:

State:

Zip Code:

1. FEIN:

2. Account ID:

3. Period:

4. If this is an amended return, check here.

5. If you are no longer in business and want your account cancelled, check this box

, enter the fi nal date. __________

6. If your mailing address has changed, check this box

and print new address below:

____________________________________________________________________

____________________________________________________________________

Quarterly Production Report

Tons

Rate

Tax Due

7. Number of tons of gypsum produced and sold as: gypsum,

land plaster, gypsum rock, or unprocessed gypsum ..............7.

X $0.05 = $

8. Number of tons of gypsum produced and made into plaster,

stucco, wallboard or other products of gypsum ......................8.

X $0.05 = $

9. Number of tons of gypsum or gypsum products containing not

less than 50% of gypsum imported into the state ...................9.

X $0.05 = $

10. Number of tons of cement manufactured in or imported into

the state ................................................................................10.

X $0.22 = $

11. Total Tax Due (add lines 7, 8, 9, and 10) ................................................................................... 11. $

Returns are due 30 days after the end of each calendar quarter. Penalties and Interest will be applied if late.

I hereby swear or affi rm under penalty of perjury that the statements contained herein are true to the best of my

knowledge.

Signature ___________________________________________

Title _______________________________________________ Phone __________________ Date ________________

Mail this return to:

Department of Revenue, PO Box 5805, Helena MT 59604-5805

1

1 2

2 3

3