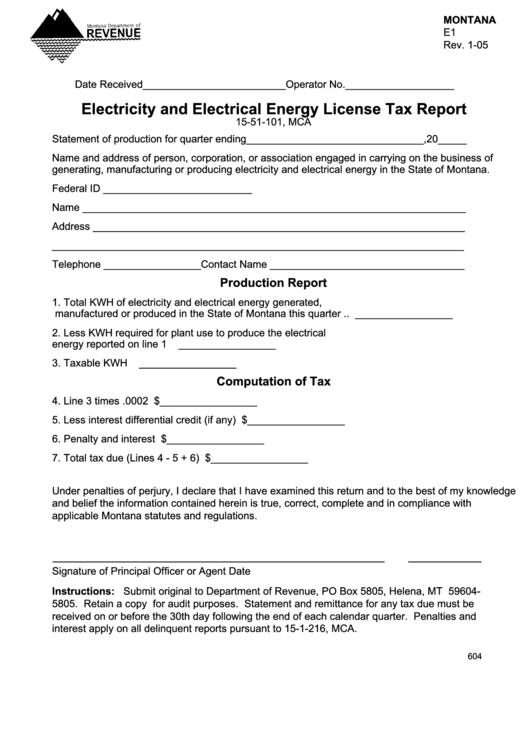

Montana

E1

Rev. 1-05

Date Received_________________________Operator No.___________________

Electricity and Electrical Energy License tax Report

15-51-101, MCA

Statement of production for quarter ending_______________________________,20_____

Name and address of person, corporation, or association engaged in carrying on the business of

generating, manufacturing or producing electricity and electrical energy in the State of Montana.

Federal ID __________________________

Name ___________________________________________________________________

Address _________________________________________________________________

________________________________________________________________________

Telephone _________________ Contact Name __________________________________

Production Report

1. Total KWH of electricity and electrical energy generated,

manufactured or produced in the State of Montana this quarter .. _________________

2. Less KWH required for plant use to produce the electrical

energy reported on line 1 ............................................................. _________________

3. Taxable KWH ............................................................................... _________________

Computation of tax

4. Line 3 times .0002 ........................................................................$_________________

5. Less interest differential credit (if any) .........................................$_________________

6. Penalty and interest .....................................................................$_________________

7. Total tax due (Lines 4 - 5 + 6) ......................................................$_________________

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge

and belief the information contained herein is true, correct, complete and in compliance with

applicable Montana statutes and regulations.

Signature of Principal Officer or Agent

Date

Instructions: Submit original to Department of Revenue, PO Box 5805, Helena, MT 59604-

5805. Retain a copy for audit purposes. Statement and remittance for any tax due must be

received on or before the 30th day following the end of each calendar quarter. Penalties and

interest apply on all delinquent reports pursuant to 15-1-216, MCA.

604

1

1