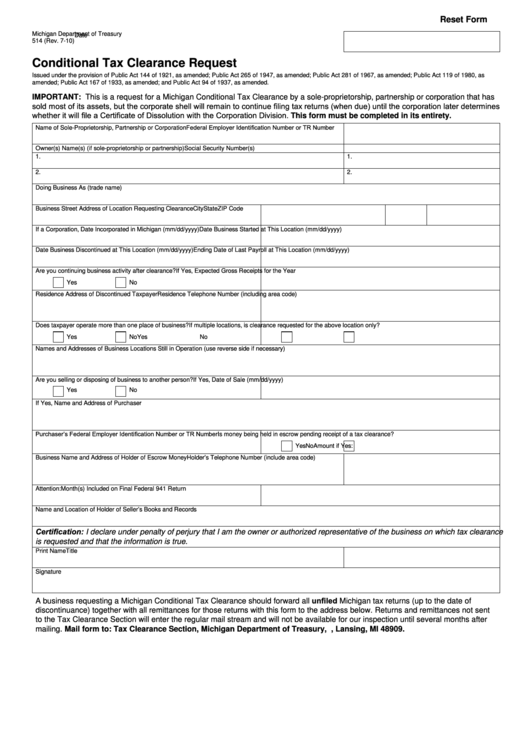

Reset Form

Michigan Department of Treasury

Date

514 (Rev. 7-10)

Conditional Tax Clearance Request

Issued under the provision of Public Act 144 of 1921, as amended; Public Act 265 of 1947, as amended; Public Act 281 of 1967, as amended; Public Act 119 of 1980, as

amended; Public Act 167 of 1933, as amended; and Public Act 94 of 1937, as amended.

IMPORTANT: This is a request for a Michigan Conditional Tax Clearance by a sole-proprietorship, partnership or corporation that has

sold most of its assets, but the corporate shell will remain to continue filing tax returns (when due) until the corporation later determines

whether it will file a Certificate of Dissolution with the Corporation Division. This form must be completed in its entirety.

Federal Employer Identification Number or TR Number

Name of Sole-Proprietorship, Partnership or Corporation

Owner(s) Name(s) (if sole-proprietorship or partnership)

Social Security Number(s)

1.

1.

2.

2.

Doing Business As (trade name)

Business Street Address of Location Requesting Clearance

City

State

ZIP Code

If a Corporation, Date Incorporated in Michigan (mm/dd/yyyy)

Date Business Started at This Location (mm/dd/yyyy)

Date Business Discontinued at This Location (mm/dd/yyyy)

Ending Date of Last Payroll at This Location (mm/dd/yyyy)

Are you continuing business activity after clearance?

If Yes, Expected Gross Receipts for the Year

Yes

No

Residence Address of Discontinued Taxpayer

Residence Telephone Number (including area code)

Does taxpayer operate more than one place of business?

If multiple locations, is clearance requested for the above location only?

Yes

No

Yes

No

Names and Addresses of Business Locations Still in Operation (use reverse side if necessary)

Are you selling or disposing of business to another person?

If Yes, Date of Sale (mm/dd/yyyy)

Yes

No

If Yes, Name and Address of Purchaser

Purchaser’s Federal Employer Identification Number or TR Number

Is money being held in escrow pending receipt of a tax clearance?

Yes

No

Amount if Yes:

Business Name and Address of Holder of Escrow Money

Holder’s Telephone Number (include area code)

Attention:

Month(s) Included on Final Federal 941 Return

Name and Location of Holder of Seller’s Books and Records

Certification: I declare under penalty of perjury that I am the owner or authorized representative of the business on which tax clearance

is requested and that the information is true.

Print Name

Title

Signature

A business requesting a Michigan Conditional Tax Clearance should forward all unfiled Michigan tax returns (up to the date of

discontinuance) together with all remittances for those returns with this form to the address below. Returns and remittances not sent

to the Tax Clearance Section will enter the regular mail stream and will not be available for our inspection until several months after

mailing. Mail form to: Tax Clearance Section, Michigan Department of Treasury, P.O. Box 30168, Lansing, MI 48909.

1

1