TIRE RETAILER INFORMATION

Per NRS 444A, effective January 1, 1992, a tire surcharge fee of $1.00 per tire for a vehicle, shall be collected.

“Tire for a vehicle” includes a tire for a motorized vehicle that is 12 inches or larger in diameter, but does not include a

recapped tire or used tire which is sold again. “Vehicle” means any device in, upon or by which any person or property is or

may be transported or drawn upon land. The term does not include:

a) Devices moved by human or electrical power;

b) Commercial coaches as defined in NRS 489.062; and

c) Mobile homes as defined in NRS 489.120.

A person who sells a new tire for a vehicle to a customer for his use and not for resale shall collect from the purchaser, at the

time he collects the applicable sales and use taxes for the sale, a fee of $1.00 per tire. The seller shall transmit 95 percent of

the collections to the Department of Taxation on forms provided. Currently, the tax is due the last day of the following

month. The remaining 5 percent may be retained by the seller to cover his related administrative costs.

TIRE SURCHARGE FEE RETURN INSTRUCTIONS

NOTE: If Line 1 on the return is ‘zero’ stop there and go to the Signature portion of the Return.

Enter the total number of tires sold in the month, multiply by $1 and enter that amount on Line 1.

1.

Multiply the total on Line 1 by 5% (.05) and enter that amount on Line 2.

2.

Subtract amount on Line 2 from amount on Line 1 and enter total on Line 3.

3.

If this return and payment will not be submitted/postmarked and the taxes paid on or before the due date as shown

4.

on the face of the return, the amount of penalty due will be based on the number of days the late payment is made

per NAC 360.395. The maximum penalty amount is 10%. Determine the number of days the payment is late and

multiply the net tax owed by the appropriate rate shown in the table below. The result is the amount of penalty that

should be entered. For example: the taxes are due January 31 but not paid until February 15. The number of days

late is 15 so the penalty is 4%.

Number of

days late

Penalty Percentage

Multiply by:

1 - 10

2%

0.02

11 - 15

4%

0.04

16 - 20

6%

0.06

21- 30

8%

0.08

31 +

10%

0.10

For reporting periods prior to April 1, 2007 the penalty is 10%.

If this return and payment will not be postmarked and the taxes paid on or before the due date as shown on the

5.

return, enter the interest on Line 5. Note:

7/1/2011 interest rate change: To calculate interest for each month late

after 7/1/2011 , multiply Line 21 × 0.75% (or .0075). To calculate interest for each month late

from 7/1/1999

through 6/30/2011, multiply Line 21 × 1% (or .01).

Enter any amount due for prior periods for which you have received a Billing for tire tax.

6.

Enter the amount due to you for overpayments made in prior periods for which you have received a credit notice.

7.

Do not take the credit if you have asked for a refund. NOTE: Only credits established by the Department may be

used.

Add Line 3 to Lines 4, 5 and 6. Continue by subtracting Line 7 from that sum. This is the Total Due and Payable to

8.

be entered on Line 8.

Enter the total amount remitted with this return on Line 9.

9.

Mail to: Nevada Department of Taxation

1550 College Parkway, Suite 115

Carson City, NV 89706

If you have questions concerning this return, please contact the Carson City District Office at 775-684-2117.

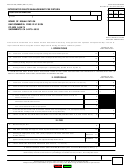

TIRE SURCHARGE FEE RETURN

EXC-TIRE-01.01

7/1/2011

1

1 2

2